Hidden Cost Of Buying A House In Malaysia

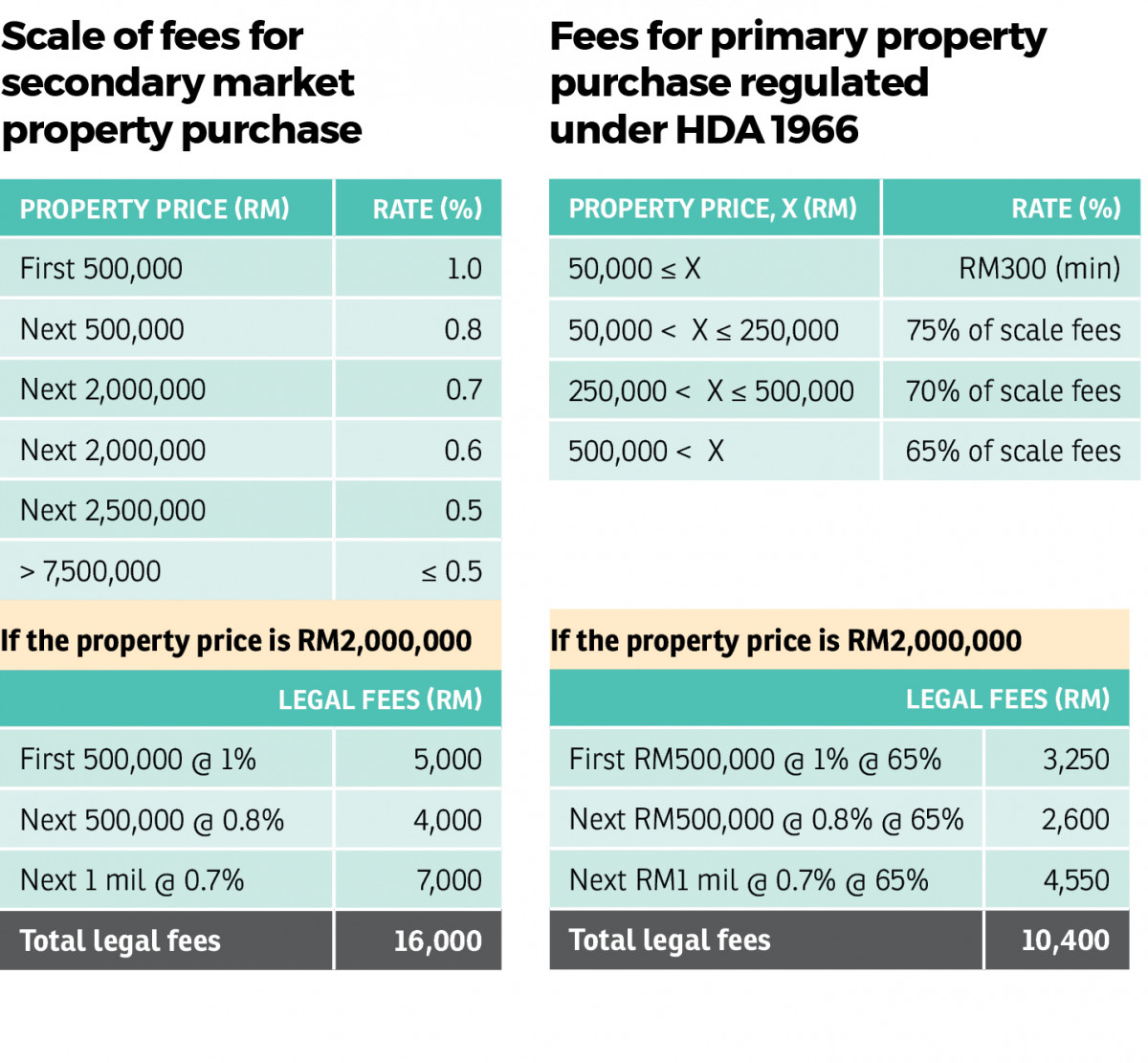

These include lawyer fees stamp duties sales purchase agreement spa fees and valuation fees.

Hidden cost of buying a house in malaysia. In malaysia most banks offer up to 90 of the property s price margin of financing for your first two residential properties. Assessment tax is charged twice a year. Your property agent may also charge you for additional costs such as marketing materials and transport but they should let you know about these charges beforehand.

For the quite rent or cukai tanah it is a once a year thing. According to bidder segers while buyers often baulk at the extra costs it s money well spent. Quit rent cukai tanah besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah.

Cost is beared by developer and sellers in most instances. The last hidden cost of buying a house in malaysia is assessment tax or in malay called cukai pintu. It generally will cost between half a percent to one percent of the entire loan on an annual basis.

Maybe it ll be 50 a month. So if you buy a house for 200 000 and put nothing down you could pay 2 000 a year in private mortgage insurance. You need to pay assessment tax to your municipal council.

Sub sale cost 480k developer cost 580k but there is 10 discount and warranty period of 2 yrs fm developer. Maybe 100 or more. Many home buyers do not anticipate the additional fees involved when buying a property in malaysia.

Having the property checked for pest and other damage can be one of the hidden costs of buying a house. There are people who make the mistake of underestimating the affordability of a property before they make a purchase. Some developers will absorb the legal and spa fees but buyers will have to settle the rest themselves.

The tax will be calculated based on the property market value. If you receive that 90 you need to prepare a 10 down payment to cover the rest of the property s price. When it comes down to the initial payments needed for buying a house the main one that most know about is the down payment price which is 10 of the total purchase price or the difference between the loan amount and the purchase price.

Annual rental value of a property varies according to factors such as market rate location and condition of the property. These checks are particularly important for older homes. Subsale maybe left a few months of defect cover and i believe as 2nd owner i will forfeit this defect cover fm developer.

In most cases it is the lack of knowledge regarding the hidden entry costs that causes complications.