Housing Loan Interest Rate Malaysia July 2020

Lowest interest rates guaranteed from all 12 major banks in singapore.

Housing loan interest rate malaysia july 2020. Compare housing loans in malaysia 2020. For example if the current br rate is 4 00 update. This is the fourth time the opr has been decreased this year pushing it to a record low.

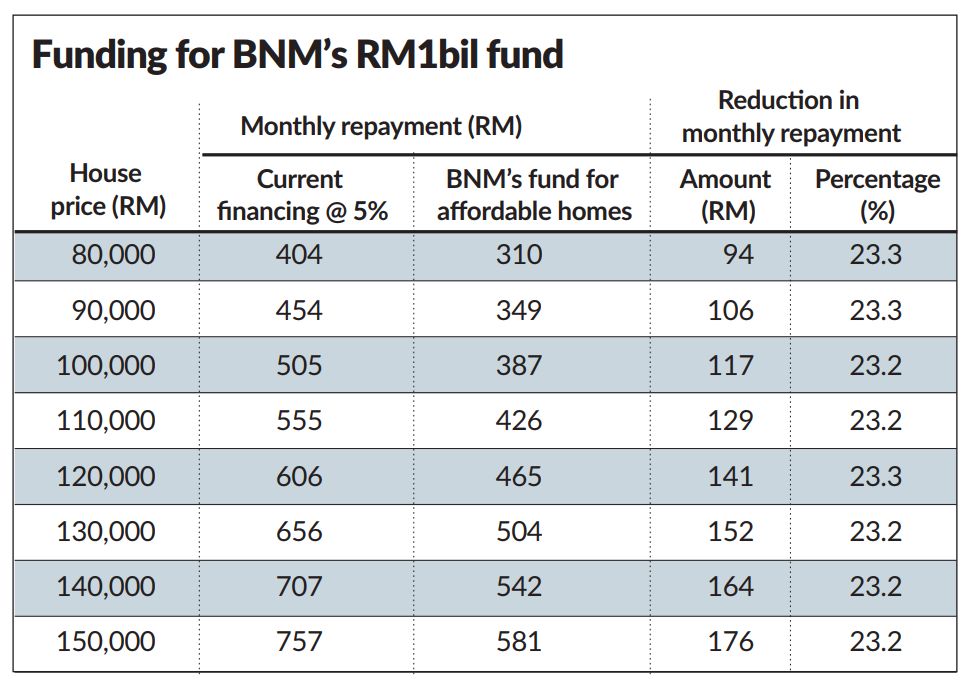

A standard housing loan home financing refers to a housing loan home financing with financing amount of rm350 000. Enter property price in malaysian ringgit. Enter housing loan period in years.

Interest rate as low as 4 15 p a. All interest dividend rates quoted may change without prior notice. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45.

Enter down payment amount in malaysian ringgit. Compare the cheapest home loans from over 18 banks in malaysia. Base lending rate blr 6 6 maximum loan amount 90.

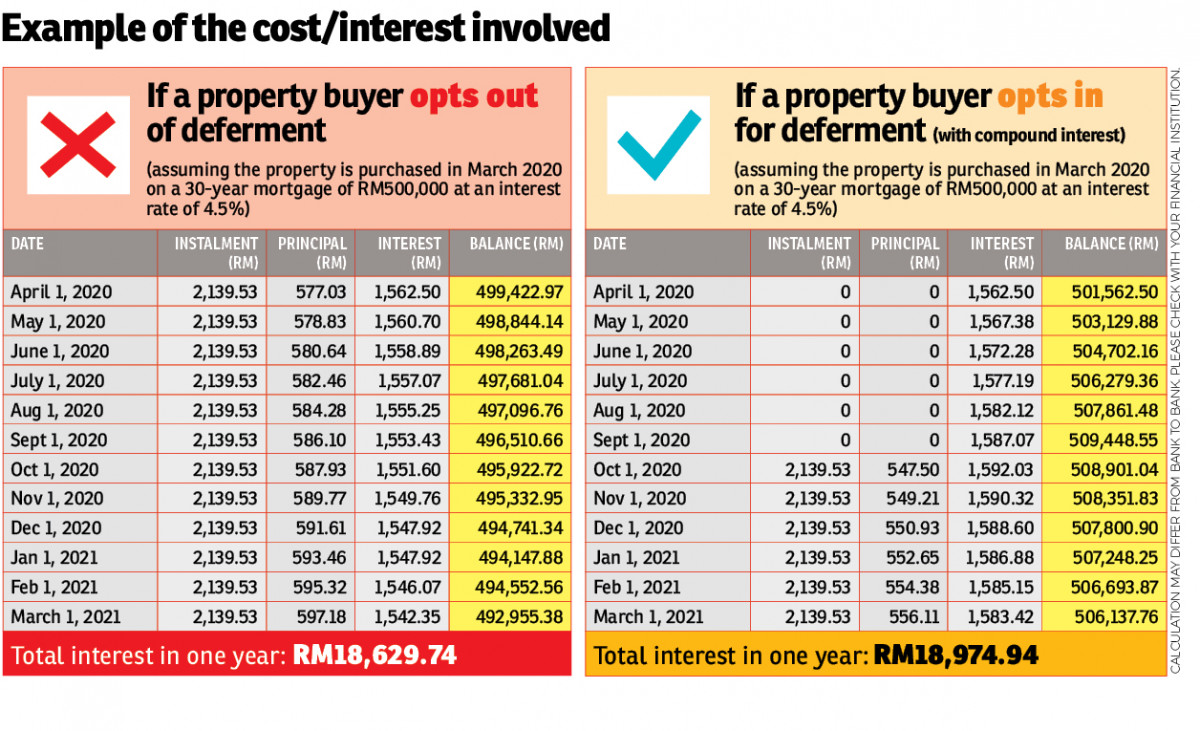

Terms conditions apply. Both quotations will have slightly different in terms of calculation. Indicative effective rate of a standard rm350 000 housing loan for 30 years.

What is base rate br disclaimer. Bank negara malaysia bnm announced another reduction of the overnight policy rate opr by 25 basis points to 1 75 on july 7 2020. With effect from 9 july 2020.

Spa loan agreement quotation includes legal fees amount disbursement fees 6 sst and stamp duty. Generate principal interest and balance loan repayment table by year. This page provides malaysia interest rate actual values historical data forecast chart statistics economic calendar and news.

Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. Stamp duty for memorandum of transfer in malaysia mot malaysia can be extremely pricey and do check out the chart below for the tier rate. Work with best broker since 2014.

Malaysia housing loan interest rates. Interest rate in malaysia averaged 2 97 percent from 2004 until 2020 reaching an all time high of 3 50 percent in april of 2006 and a record low of 1 75 percent in july of 2020. Get interest rates from as low as 4 15 on your housing loan.

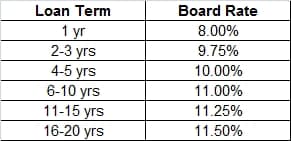

Effective 13 july 2020 rate p a base rate.