How To Buy Etf In Malaysia

Like shares etfs are traded in minimum lots of 100 units in bursa malaysia and as low as 1 unit in international markets.

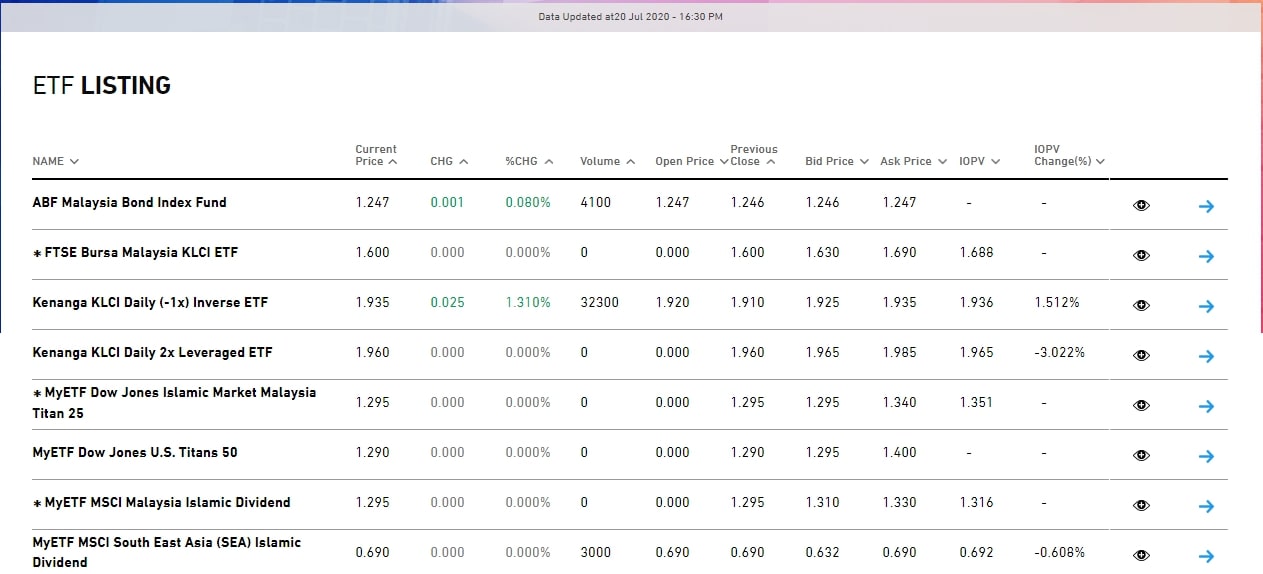

How to buy etf in malaysia. Luckily you can also buy some etf s on the main market of bursa malaysia. For more details of the etfs please refer here. The equity etfs that are offered allow you to invest in china consisting of the 50 largest and most liquid companies.

The fee range for etfs in malaysia is between 0 2 0 8 in management fee per year. Cons of buying etfs through bursa malaysia. It is the frontline regulator of the malaysian capital market and has to maintain a fair and orderly market in the securities and derivatives that are traded through its facilities.

You can buy these funds through bursa malaysia robo advisory platforms and etf brokers. Pros of buying etfs through bursa malaysia. Just use your cds account to buy the etf you want.

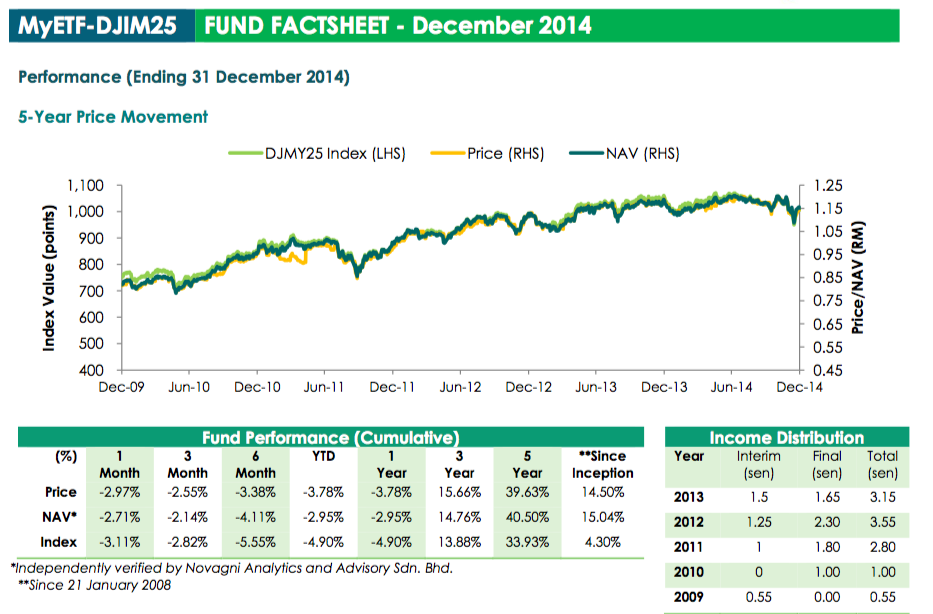

How to buy an etf in malaysia you incur costs like buying and selling stocks when buying an etf including brokerage commission stamp duty and clearing fees. Before you decide to run out to buy a malaysian etf here s what you should know about etfs and the reasons why you should be excited to have more local etfs emerging on bursa. Usually mutual funds have a management fee of between 1 2.

Bursa malaysia is the official stock exchange in malaysia. Syariah compliant etfs are available. The securities commission malaysia sc revised the guidelines on exchange traded funds in january 2019 to promote etf growth and product innovation in the market.

There are currently 12 etfs listed on bursa malaysia and more to come in the future. Should be easy if you are already familiar with the stock buying process. You can find a full list of the 12 etfs by clicking on the following link.