How To Calculate Kwsp Contribution

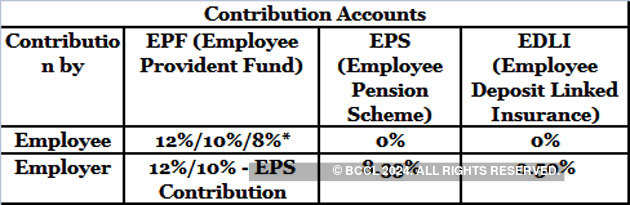

Interest on the employees provident fund is calculated on the contributions made by the employee as well as the employer contributions made by the employee and the employer equals 12 or 10 includes eps and edli of his her basic pay plus dearness allowance da.

How to calculate kwsp contribution. Interest on the epf contribution for may 4 700 0 7083 33 29. Your employee s contribution to epf and your employer s contribution. While in savings these funds may be used in.

The epf officer will provide form kwsp 7 form e and form kwsp 8 form f. How to use epf calculator. Check eligibility check your eligibility.

For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13. The interest rate earned on the epf balances as declared by the government each year. A 10 rate is applicable in the case of establishments with less than 20 employees sick units or units that meet certain.

Our epf calculator is one step solution to all your epf related calculation questions. Calculators try out our calculators for all your needs. Total epf contribution for may 4 700.

The epf functions through monthly contributions from employees and their employers towards saving accounts. Kwsp epf contribution rates. How to calculate epf contribution.

Epf calculator is an online tool and hence can be used anywhere anytime. Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following. Interest on the epf contribution for april nil no interest for the first month epf account balance at the end of april 2 350.

Details which you need to provide are as below. This amount is calculated each month. Check eligibility check your eligibility.

What it shows after entering the above information and submitting it the calculator will show how much you will save by the time you will retire. Total epf contribution for april 2 350. It easily calculates the return on your epf contribution within no time.

Overview the epf employees provident fund is a malaysian government agency that manages a compulsory savings plan and retirement planning for private and non pensionable public sector employees. Under certain circumstances the epf will make an assessment of the contribution. Your epf contribution your contribution towards epf is 12 of rs 25 000 which amounts to rs 3 000 each month.

This calculator helps you to estimate your total savings in epf when you retire. Late payment charge check eligibility check. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.