How To Calculate Overtime In Malaysia

Rules explained in this article apply to employees covered under the employment act e g.

How to calculate overtime in malaysia. Minimum wage is the lowest wage permitted by law or by a special agreement. 6 the minister may make regulations for the purpose of calculating the payment due for overtime to an employee employed on piece rates. Sep 24 2020 how to identify and manage overqualified candidates.

A workman earning up to 4 500. Your ultimate hiring solutions. This minimum wages also defined as the minimum amount of remuneration that an employer required to pay wages malaysia earners for performance work during a given period.

Overtime calculator refers to calculation of any hours worked by an employee that exceed their normally scheduled working hours in payroll software malaysia. Sep 22 2020 about us. A non workman earning up to 2 600.

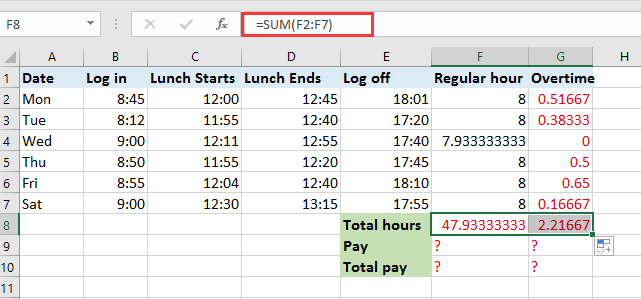

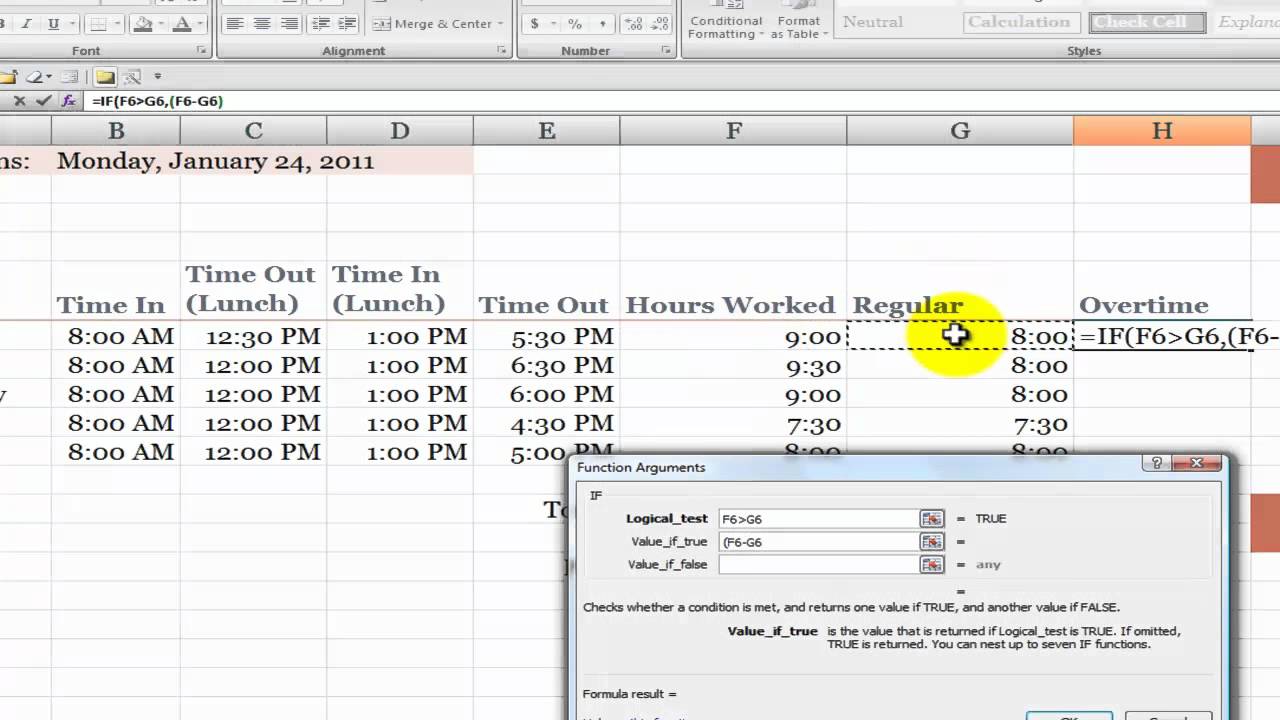

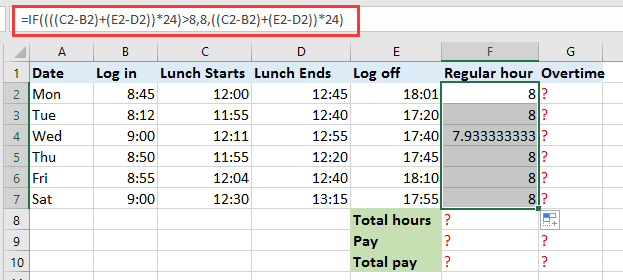

In the formula f8 and g8 are the cells containing total regular hours and total overtime i2 and j2 contain the payment per hour. You can claim overtime if you are. The payrollpanda app automatically calculates overtime for more info you can refer to this help article.

Maternity leave paternity leave in malaysia s private sector. If the employee s salary does not exceed rm2 000 a month or falls within the first schedule of employment act. In the cells which you want to calculate the payment for regular hours and overtime enter the formula f8 i2 and formula g8 j2 separately see screenshots.

Sep 24 2020 medical and hospitalization leave in malaysia. In malaysia overtime is still popular among companies especially in the f b sector. How to calculate wage for salary calculator malaysia 2020.

In this article we will study the laws governing the hours of work and overtime work for employees under malaysia s labour laws. While a generalized overtime rate refers simply to those hours worked outside of the standard working schedule overtime calculator commonly refers concurrently to the employee s remunerations of such work. A non workman earning up to 2 600.

The overtime rate payable for non workmen is capped at the salary level of 2 600 or an hourly rate of 13 60. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax. B for the purposes of the restriction on overtime under this subsection overtime shall have the meaning assigned thereto in subsection 3 b.

What are the overtime rates according to the employment act. If monthly salary is rm 5 000 with a yearly bonus of rm 5 000 then for an employee who is not married the combined tax for both salary and bonus is rm 650. Calculate overtime pay for a monthly rated employee if you are a monthly rated employee covered under part iv of the employment act use this calculator to find out your pay for working overtime.

You can claim overtime if you are. Find get the people you need.