How To Calculate Salary Per Day In Malaysia

Can u please tell me in detail thanks sadiq.

How to calculate salary per day in malaysia. 2 how we can calculate when total days of month are 25 without rest days and worked days are 20. Calculate your pay for working on a public holiday or for a public holiday falling on a non working day. 3 where an employee is employed on a daily rate of pay or on piece rates the ordinary rate of pay shall be calculated by dividing the total wages earned by the employee during the preceding wage period excluding any payment made under an approved incentive payment scheme or for work done on any rest day any gazetted public holiday granted by the employer under the contract of service or.

If you make rm 70 000 a year living in malaysia you will be taxed rm 10 582 that means that your net pay will be rm 59 418 per year or rm 4 952 per month. If you are a monthly rated full time employee use this calculator to calculate your salary for an incomplete month of work. This calculator also assumes 52 working weeks or 260 weekdays per year in its calculations.

Your average tax rate is 15 12 and your marginal tax rate is 22 50 this marginal tax rate means that your immediate additional income will be taxed at this rate. This calculator is for months worked in 2019 and 2020. Download the table of working days per month for 2019 and 2020.

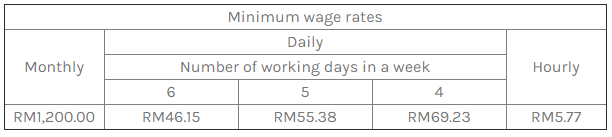

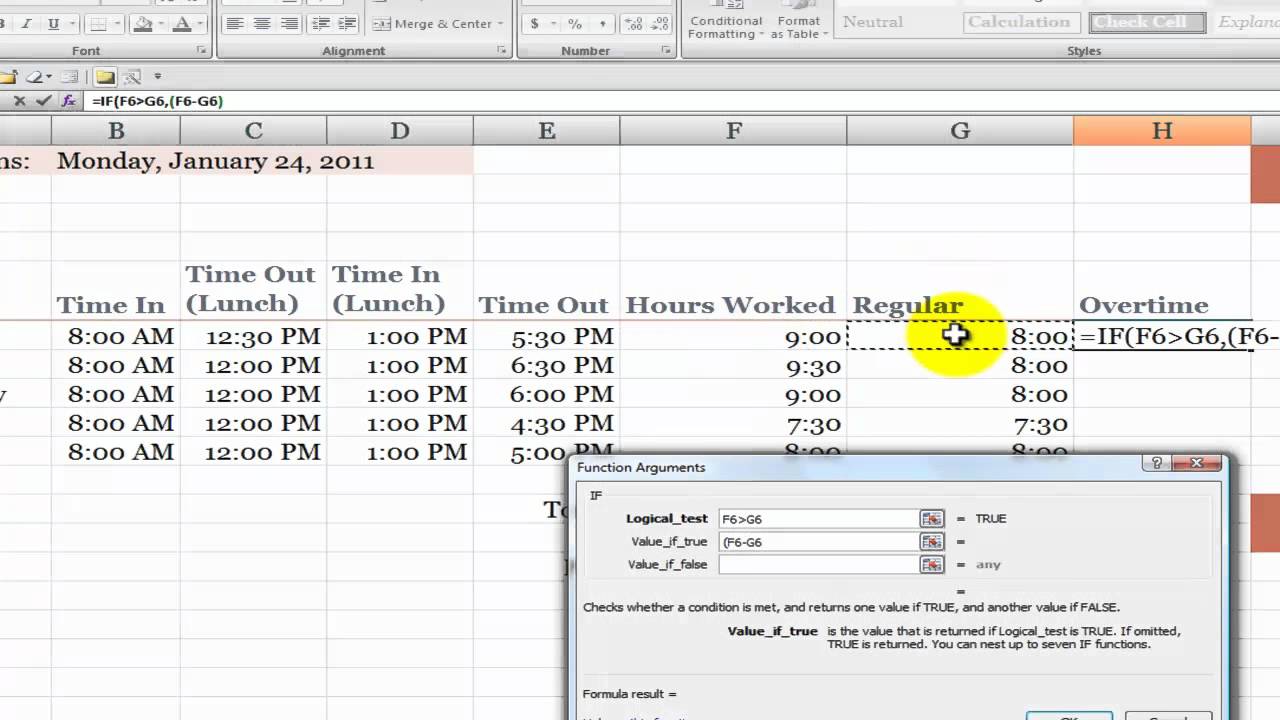

All other pay frequency inputs are assumed to be holidays and vacation days adjusted values. The overtime calculator rate payable for non workmen is capped at the salary level of myr1250 00 and have work of 44 hours a week for overtime calculator for payroll software malaysia work your employer must pay you at least 1 5 times the hourly basic rate of pay. Payment must be made within 14 days after the last day of the salary period.

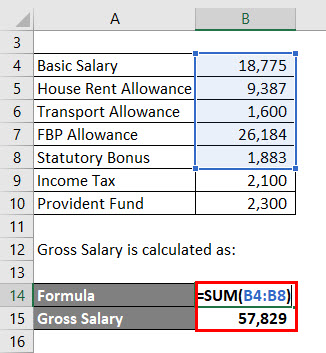

Salary calculator malaysia is important to declare your salary according to payroll malaysia in johor bahru for employer and employee. Is the total amount of deductions made on the employee s gross salary calculator on a per month basis. Calculate overtime pay for monthly rated employees covered under part iv of the employment act.

Salary 6000 1 how we can calculate when total days of month are 27 without rest days and worked days are 20. Calculate pay for work on rest day. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus only tax.

Calculate public holiday pay. I have some confusions regarding per day salary calculation on the basis of 26 days. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

The unadjusted results ignore the holidays and paid vacation days. Select a tax calculator from the list below that matches how you get paid or how your salary package is detailed. Calculate your income tax in malaysia salary deductions in malaysia and compare salary after tax for income earned in malaysia in the 2020 tax year using the malaysia salary after tax calculators.