How To Claim Gst Refund In Malaysia

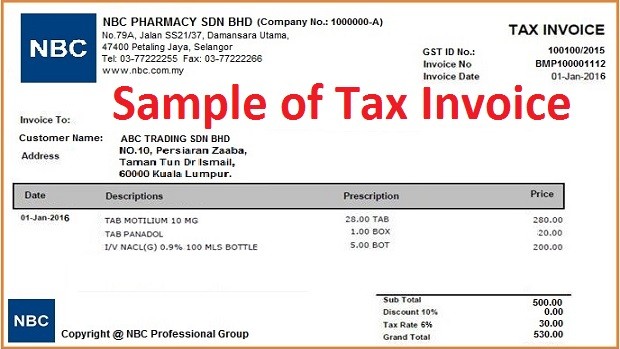

Claiming your gst refund malaysia is not difficult but you need to know what to do before you make your purchases to ensure that you have your tax invoice from an approved sales outlet.

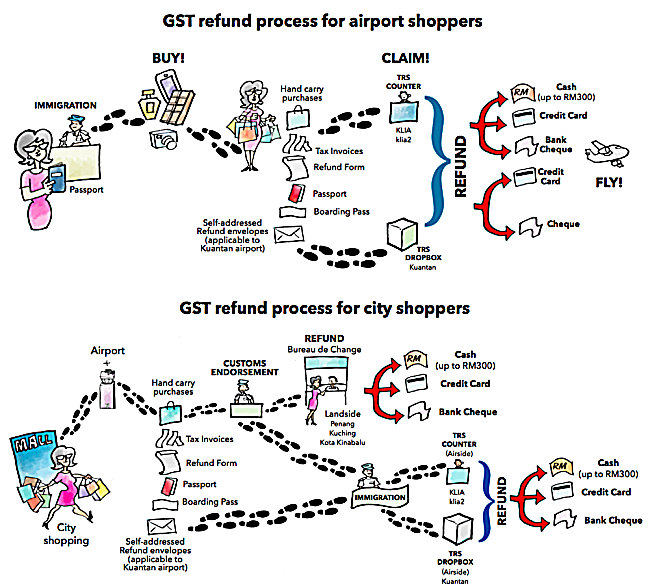

How to claim gst refund in malaysia. The scheme allows tourists to claim a refund of the goods and services tax gst paid on goods purchased from participating retailers if the goods are brought out of singapore via changi international airport or seletar airport. Any refund of tax may be offset against other unpaid gst customs and excise duties. Trs is a scheme that allows tourists to claim gst paid on eligible goods purchased in malaysia.

Tourists can claim this 6 tax under certain conditions. The term input tax credit itc is one of the features or mechanisms of goods and services tax gst input tax credit is introduced to help to eliminate the cost cascading effect of the pre gst tax regime. As a tourist in singapore if you make any purchase of more than s 100 including gst at participating shops you may claim a refund on the 7 goods and services tax gst paid on your purchases.

Goods services tax in malaysia. Jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana. This page is also available in.

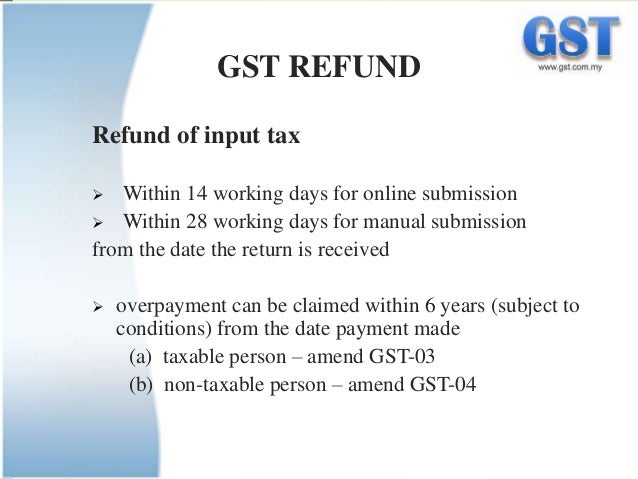

The investigation usually involves a request for further information and supporting documents typically communicated via the taxpayer access point tap or via a letter an email or a phone call. Melayu malay 简体中文 chinese simplified gst input tax credit refund claiming. Picture by miera zulyana kuala lumpur june 15 the finance ministry through the royal malaysian customs department is committed to ensuring that the goods and services tax gst refund to taxpayers will be expedited and payment to be made beginning june 22.

When purchasing from gst registered suppliers or importing goods into singapore you may have incurred gst input tax. Since april 1st 2015 goods services tax has replaced sales and services tax in malaysia. Often this happens when customs carries out an investigation or audit to validate the gst return filed before releasing the gst refund to the taxpayer.

You must make your claim during the accounting period that matches the date shown in the tax invoice or import permit. Gst goods and services tax is a local tax on products food and more. Claiming gst refunds.

Finance minister tengku datuk seri zafrul abdul aziz said the gst refund payment process would be completed by december this year. You can claim input tax incurred when you satisfy all of the conditions for making such a claim. You are entitled up to 3 same day receipts invoices from shops bearing the same gst registration number and shop name to meet this minimum purchase amount of s 100.

It applies only to the tax paid on goods your purchases at shopping outlets not the gst on food accommodation etc.