How To Declare Dividend In Malaysia

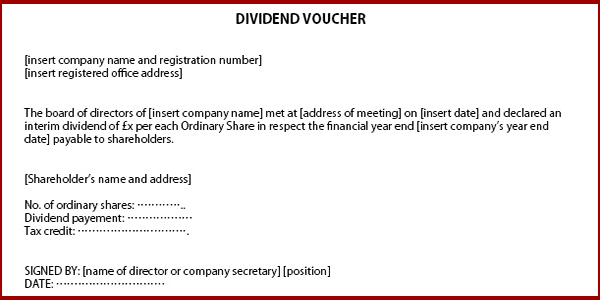

The total dividend liability is now 90 000 and the journal to record the.

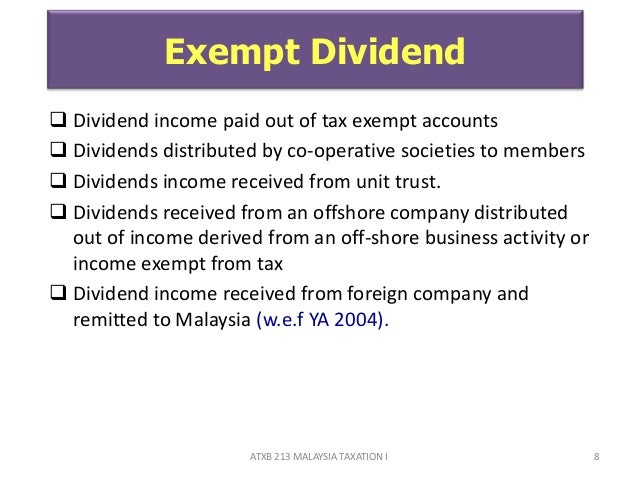

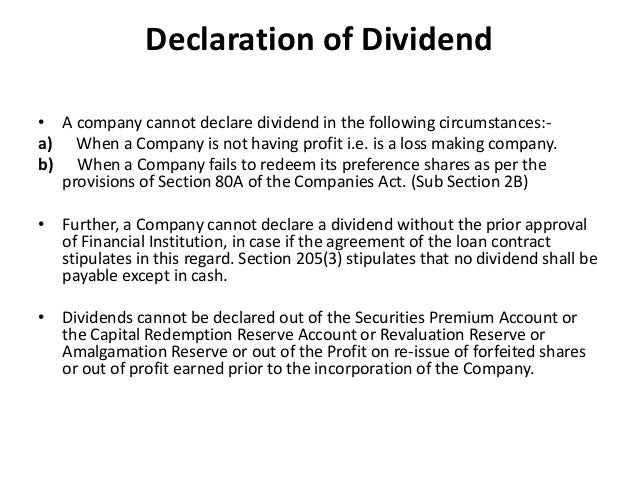

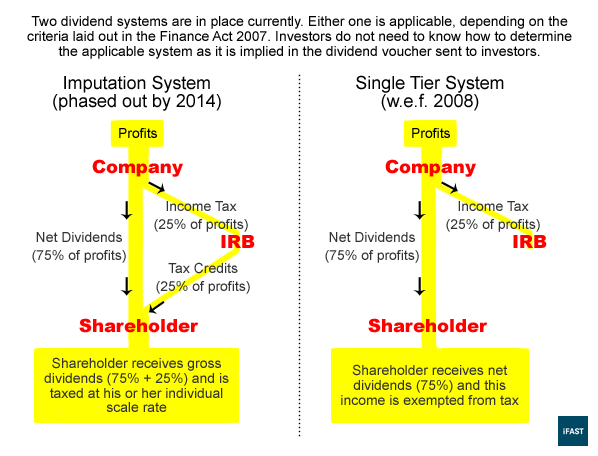

How to declare dividend in malaysia. Under the current companies act 1965 dividends can only be paid to shareholders. Key changes to the dividend regime. Suppose a business had declared a dividend on the dividend declaration date of 0 60 per share on 150 000 shares.

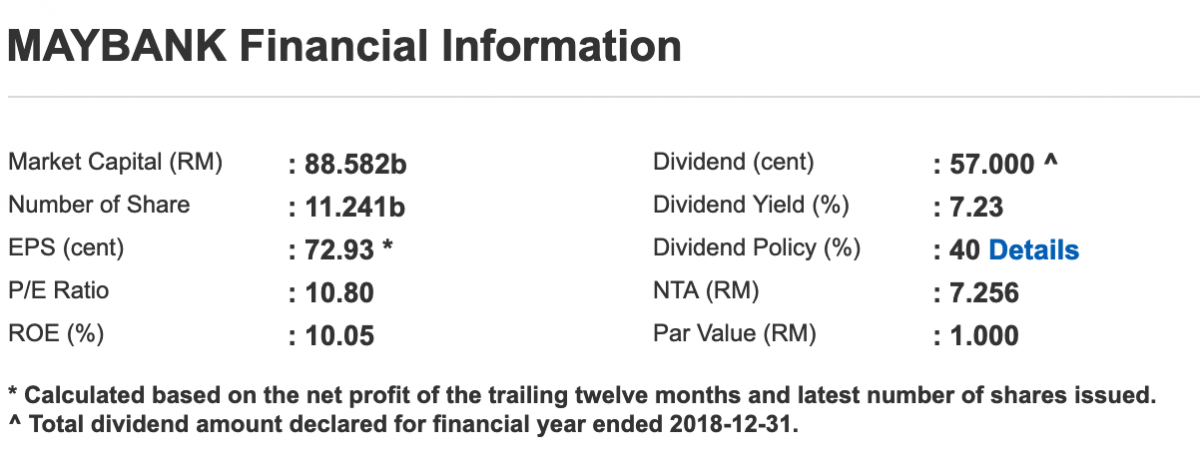

Date stock ex date entitlement date payment date entitlement type dividend cent dividend details. As soon as the dividend has been declared the liability needs to be recorded in the books of account as a dividend payable. The dividend yield shows you how much dividends you ll get if you buy a certain amount of the company s stock.

The brand new registered enterprises in malaysia can postpone the dividend payment to the shareholder for the first two years retaining the profits to a further development of the company. The dividends in malaysia can be distributed once twice per year or quarterly according to the rules of the company and considering the financial status. Bursa malaysia latest dividend news.

Under the one tier corporate tax system shareholders will not be taxed on dividends paid on or after 1 jan 2008 by a singapore resident company. On the other extreme dividend declared by the board of directors at the company s annual general meeting after the completion of the financial year is known as a final dividend. For example if a stock has a 4 dividend yield and you have bought rm10 000 worth of shares you ll get rm400 in dividends.

Pursuant to the application of a company s share premium account towards payment of dividends if such dividends are satisfied by the issue of shares i e.