How To File Tax For Sole Proprietorship In Malaysia

The following are the 3 forms of business entities you can choose from.

How to file tax for sole proprietorship in malaysia. If you have received full time or part time income from trade business vocation or profession you are considered a self employed person. Usually you dont hire accountants for sole proprietorship unless you have so many receipts and making big bucks. Tax file register your llp for a tax file at a nearby lhdn branch.

Thanks largely to the usage of technologies systems by ssm malaysia. Site will be available soon. The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn.

B budgeting saving. Basic checklist on keeping accounts preparing statement of accounts and filing income tax for sole proprietors and self employed persons including freelancers commission agents taxi drivers private hire car drivers and hawkers. Read on to learn about your income tax rate and filing your 2018 personal income tax with lhdn.

The easiest type of company to register is a sole proprietorship which only costs rm30 if you use your own. The tax rate for sole proprietorship or partnership will follow the tax rate of an individual. Calculating personal income tax in malaysia does not need to be a hassle especially if it s done right.

To check and sign duly completed income tax return form. Use form cp 600pt. Please note sole proprietor and partnership declare their tax under business section of their personal income tax.

To start a business in malaysia you need to register your new company with ssm malaysia formerly known as rob. It costs rm 10 and takes just a few minutes. You can stamp your llp agreement at any lhdn branch.

Bhd berhad all declare it under their own company name and pay corporate tax. Precedent partner is also responsible for informing lhdnm officially if the partnership ceases changes to a sole proprietorship private limited company. All profits and losses go directly to the business owner.

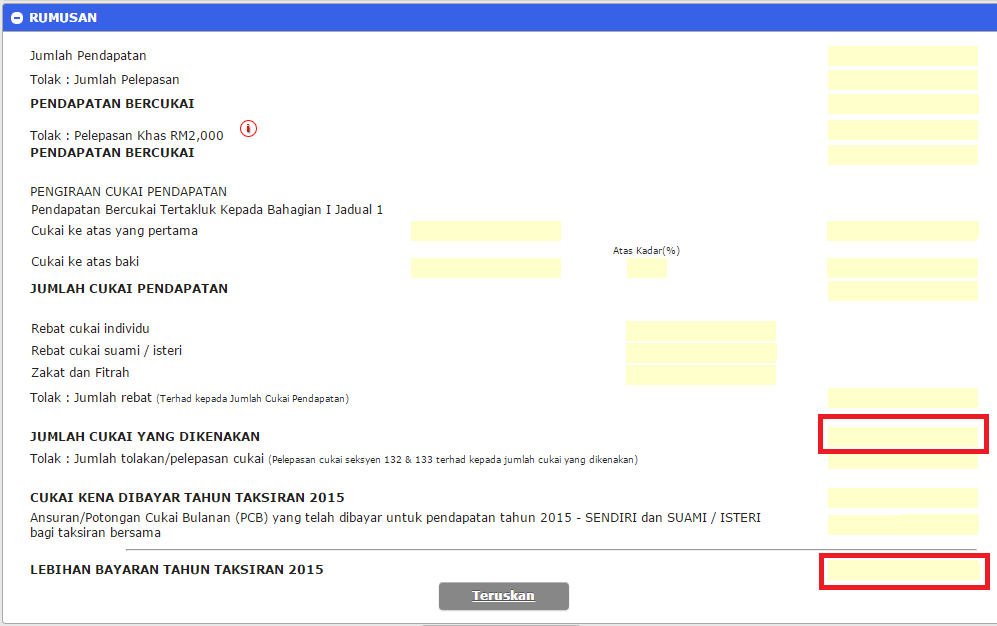

To compute their tax payable. Thereby no separate tax return file is needed sole proprietorships in malaysia are charged the income tax on a gradual scale applied to individual income from 2 to 26. A sole proprietorship in malaysia makes no difference between the natural person who owns it and the business sole proprietorships are pass through entities.

You have to report this income in your tax return. Thank you for your patience. This page shows the relevant information to help you prepare and file your tax return.

Husband and wife have to fill separate income tax return forms.