How To Invest In Unit Trust Malaysia

Use the guide below to find the best unit trust investments based on your risk appetite.

How to invest in unit trust malaysia. Unit trusts are not protected by perbadanan insurans deposit malaysia. I won t go to the technical part of unit trust but rather the practical aspects today. Below depending on your objective you will find the best performing unit trust funds to invest and grow your money.

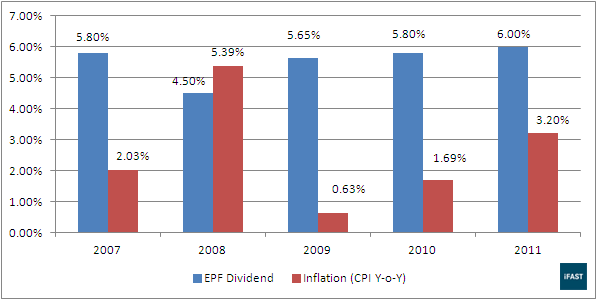

Purchase directly from the unit trust offices or through their certified consultants. Epf members can refer to their epf statement as well as the basic savings table to check their eligibility and quantum of investment allowed. Returns from unit trusts you invest in a fund by buying units in the fund.

Regularly invest a fix amount in a unit trust fund regardless of market trend is called the ringgit cost averaging strategy. Investors may also invest into unit trust funds from their epf account 1 if he or she is eligible. The price of each unit is based on the fund s net asset value nav divided by the number of units outstanding.

Investors cannot be blamed because there are more than 2 000 unit trusts and 100 etfs registered in singapore picking the right one to invest can just be mind boggling. When the equity market is high you buy less unit with the same amount. Find the best unit trust investment in malaysia.

For pmb investment the consultants are authorised unit trust consultants and institutional unit trust advisers iuta such as apex investment services berhad phillip mutual berhad and ifast capital sdn bhd. Investors are not covered by the compensation fund under section 158 of the capital markets and services act 2007 cmsa. There are 3 common strategies used in unit trust investment.

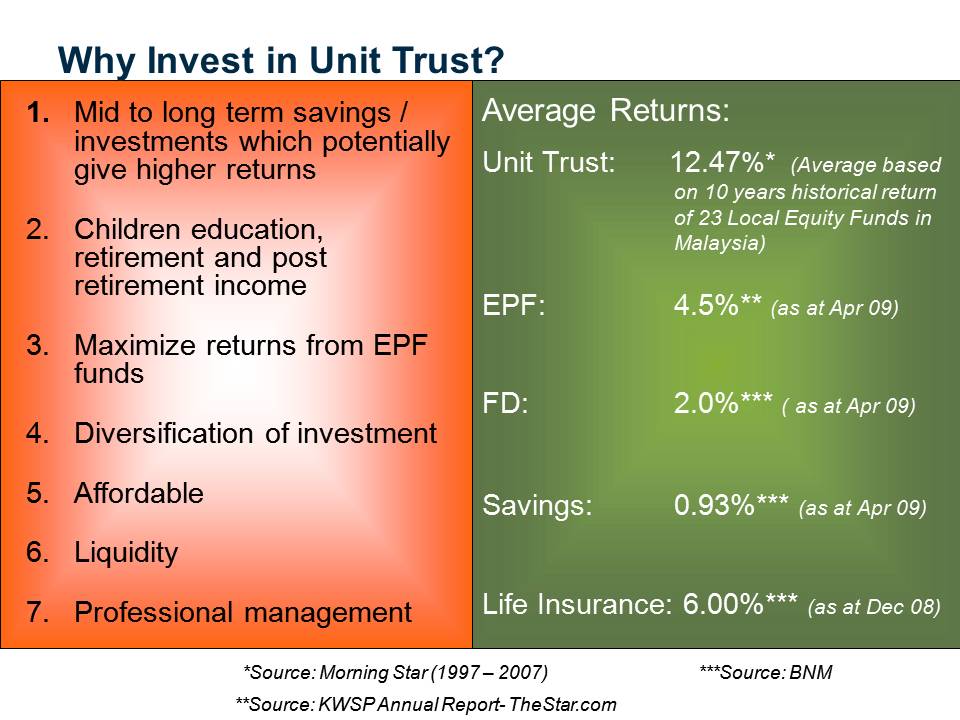

If you would like to enjoy the benefit of diversification with unit trusts investment you can invest a lump sum amount or set up a monthly investment plan. Whether you are a seasoned investor or a beginner unit trusts may be the way to go. There is a capital gain when the price of the units rises above the price you paid for the fund.

Investors should not make payment in cash to a unit trust consultant or issue a cheque in the name of a unit trust. Some funds pay dividends. Top 5 performing funds for short term investment 1 5 years if you re investing for short term gain typically within 3 months to 5 years you must make sure that the fund you re investing can give a higher return than fixed deposit rate which averages around 3.

The actual market performance is fluctuating.