How To Pay Gst Malaysia

Apa apa permohonan rayuan cbp.

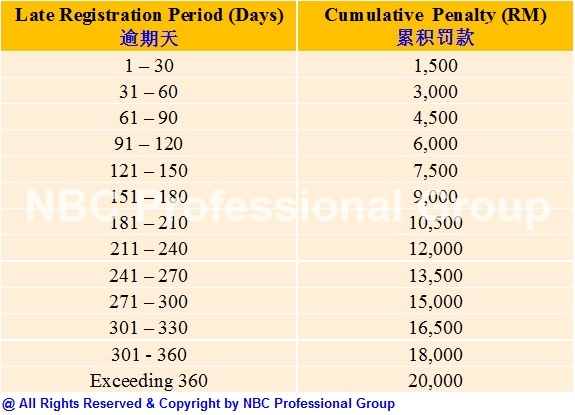

How to pay gst malaysia. 1 14 manual payment at gst processing centre gpc payments can also be made manually using cheque or bank draft that attached together with payment voucher in an envelope and post it to. 22 jalan ss 6 3 kelana jaya 47301 petaling jaya selangor. Crowds flock to malaysia malls as gst drops to zero.

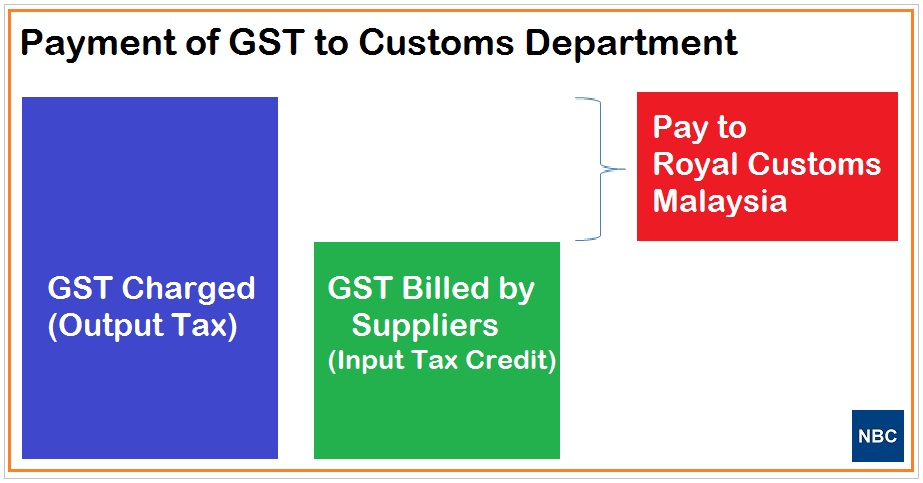

You need to use your own bank account when signing up for master giro. Goods and services tax or gst is a broad based consumption tax levied on the import of goods collected by singapore customs as well as nearly all supplies of goods and services in singapore. Generally all imported goods into malaysia are subject to gst.

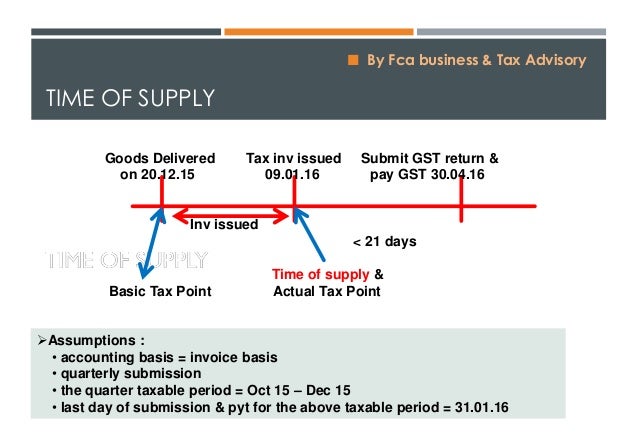

All documents related to importation must be kept for a period of seven years. Cheque payable to. Sales and service tax sst in malaysia.

Picture by miera zulyana kuala lumpur june 15 the finance ministry through the royal malaysian customs department is committed to ensuring that the goods and services tax gst refund to taxpayers will be expedited and payment to be made beginning june 22. Recommended master giro application form return envelope pdf 1 29mb a master giro allows you to pay your goods services tax and or property tax by completing one giro application form. Pusat pemprosesan cbp jabatan kastam diraja malaysia kompleks kastam wpkl no.

Berikutan pemansuhan akta cukai barang dan perkhidmatan 2014 akta 762 yang berkuat kuasa pada 1 september 2018 semua urusan permohonan rayuan cukai barang dan perkhidmatan cbp telah dipindahkan di bawah bidang kuasa tribunal rayuan kastam kementerian kewangan malaysia. Gst application form return envelope pdf 1 87mb for taxpayers not using own bank account to sign up for giro. In other countries gst is known as the value added tax or vat.

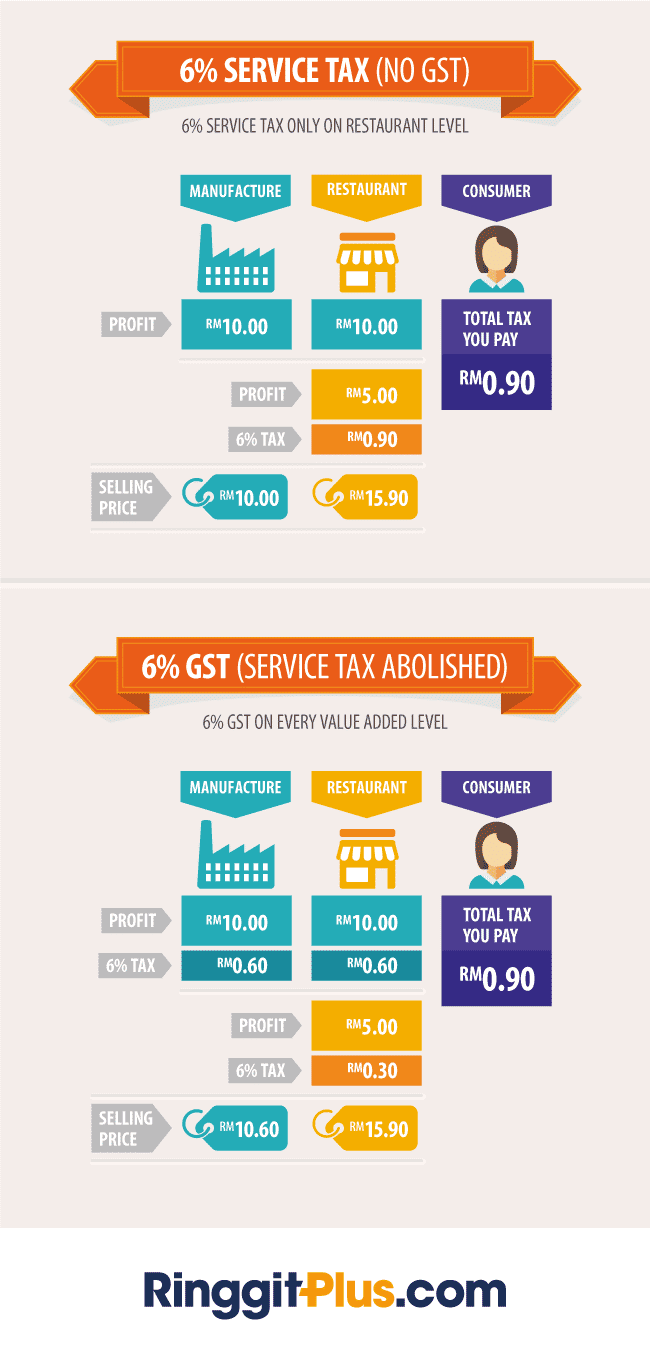

A a goods and services tax. Here are the details on how the sst works the registration process returns and payment of the sst and the transitional measures to take after the abolishment of the gst. The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018.

While the percentage charged on goods appears to be higher than under the old system a total of 5 443 items have been declared exempt. The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018. Attention please be informed that this portal will remain active until further notice.

Finance minister tengku datuk seri zafrul abdul aziz said the gst refund payment process would be completed by december this year. However certain goods imported by any person or class of persons are given relief from payment of gst upon importation under the goods and services tax relief order 2014.