How To Spend Money Wisely As A Teenager

Budgeting for teens grow your money while you re young.

How to spend money wisely as a teenager. Instead of buying an expensive new blu ray player for the living room consider taking a weekend trip to a nearby city and seeing the town. Saving is a fabulous way to enhance your self control so if your teen doesn t have a savings account now encourage them to go and open one. We hope this series will be a good place to start.

These tips will help you spend money wisely so you don t start your adult life out broke. How teens can save money. But think for a second.

How to make money a guide for teens. If that figure is accurate it means that teens are spending nearly triple what they earn. Experiences tend to stay with you.

This article is part of a series teaching essential personal finance concepts to teenagers. How to spend money wisely a guide for teens. The more you can get out of every dollar you spend the more money you will have to save for potential emergencies a college education for your children vacations to exotic locations or whatever big ticket item your heart desires.

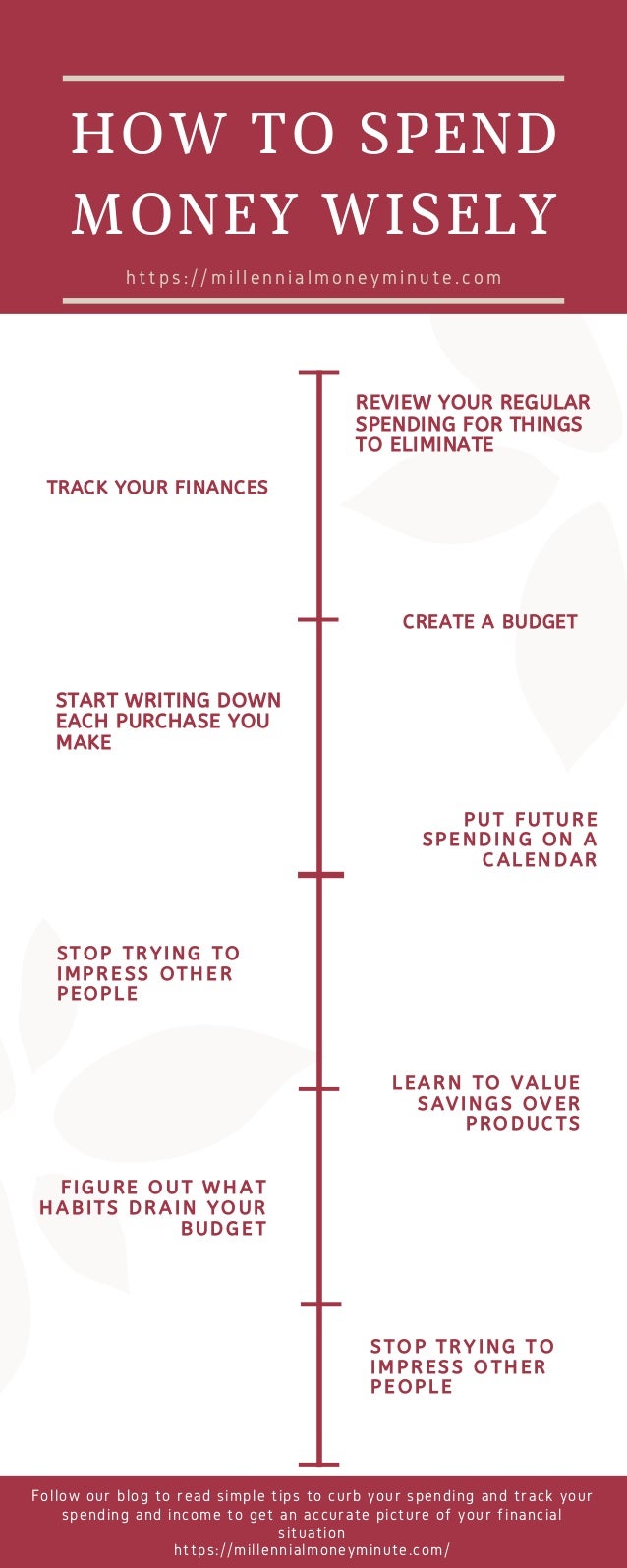

To get you started here are 7 ways to spend money wisely. Spending problem often faced by college s students and other teenagers because they usually spend their money for some personal stuff like magazine entertainment gadget. The giss give invest save spend method of managing money is a simple powerful way for people of any age to manage their money and build their way to personal and financial success.

If you want to spend money wisely create a budget to track how much money you spend on each category such as food clothing entertainment and living expenses. Check out other articles such as make money for teenagers. One way you can motivate your teen is to offer to match a certain percentage of whatever they save for a particular.

Mom and dad may be taking on debt to feed teen spending. 6 money lessons our parents learned in school but we didn t. Spend on experience over physical goods.

At money under 30 we believe that it s never too early to become financially responsible. Your teen will be more motivated to spend wisely if he or she is saving for a new laptop computer or for college. Pony up for quality where it counts.

Having concrete and specific goals in mind can help your teen have more focus when it comes to managing their money. One of the most startling statistics to come out of the marketingvox rand research centers on teens total annual spending which sits just shy of 259 billion annually. Let s face it we all love money and love to spend that money.

Young people also liked to spend their money for a temporary pleasures like watching movies in cinema playing games at cybercafé karaoke and others. 7 tips on saving for college as a teen. Then try to plan each purchase in advance so you know how much money you will be spending and will be able to avoid impulse purchases.

/list-of-monthly-outgoings-85184640-5b7db436c9e77c00570e9220.jpg)