How To Submit Form E

Once you have done this check the final page which will include the checklist of evidence.

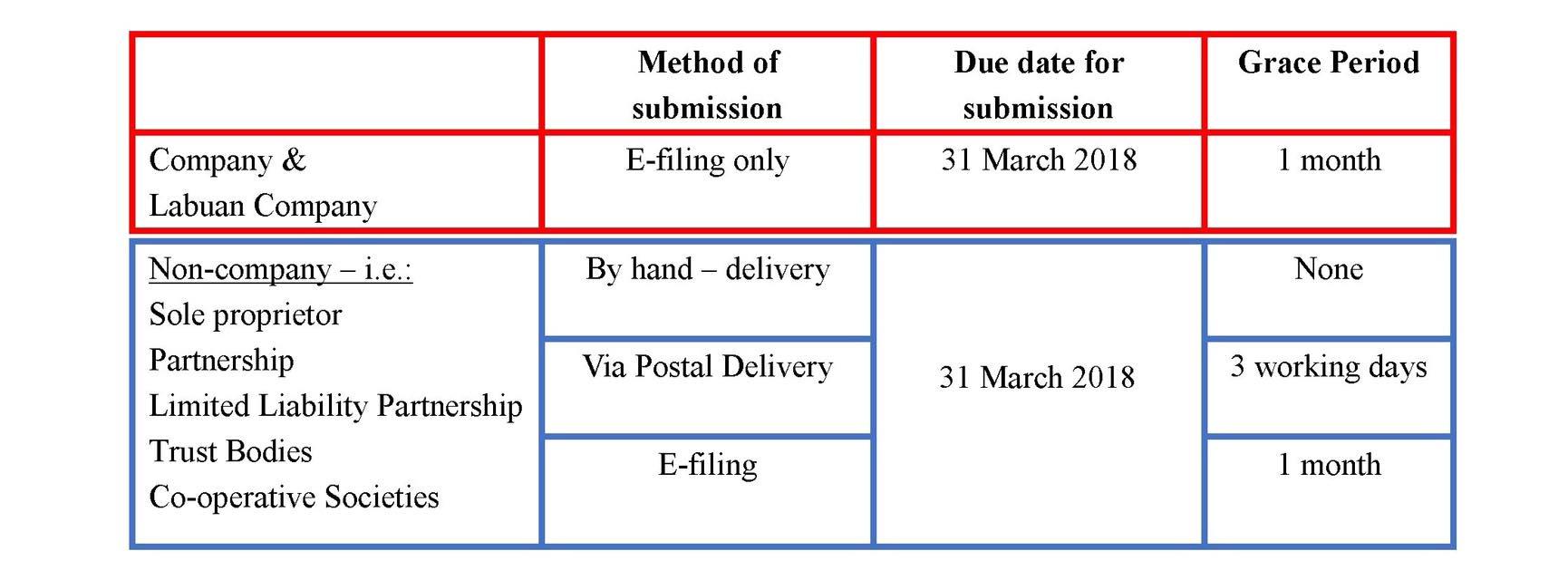

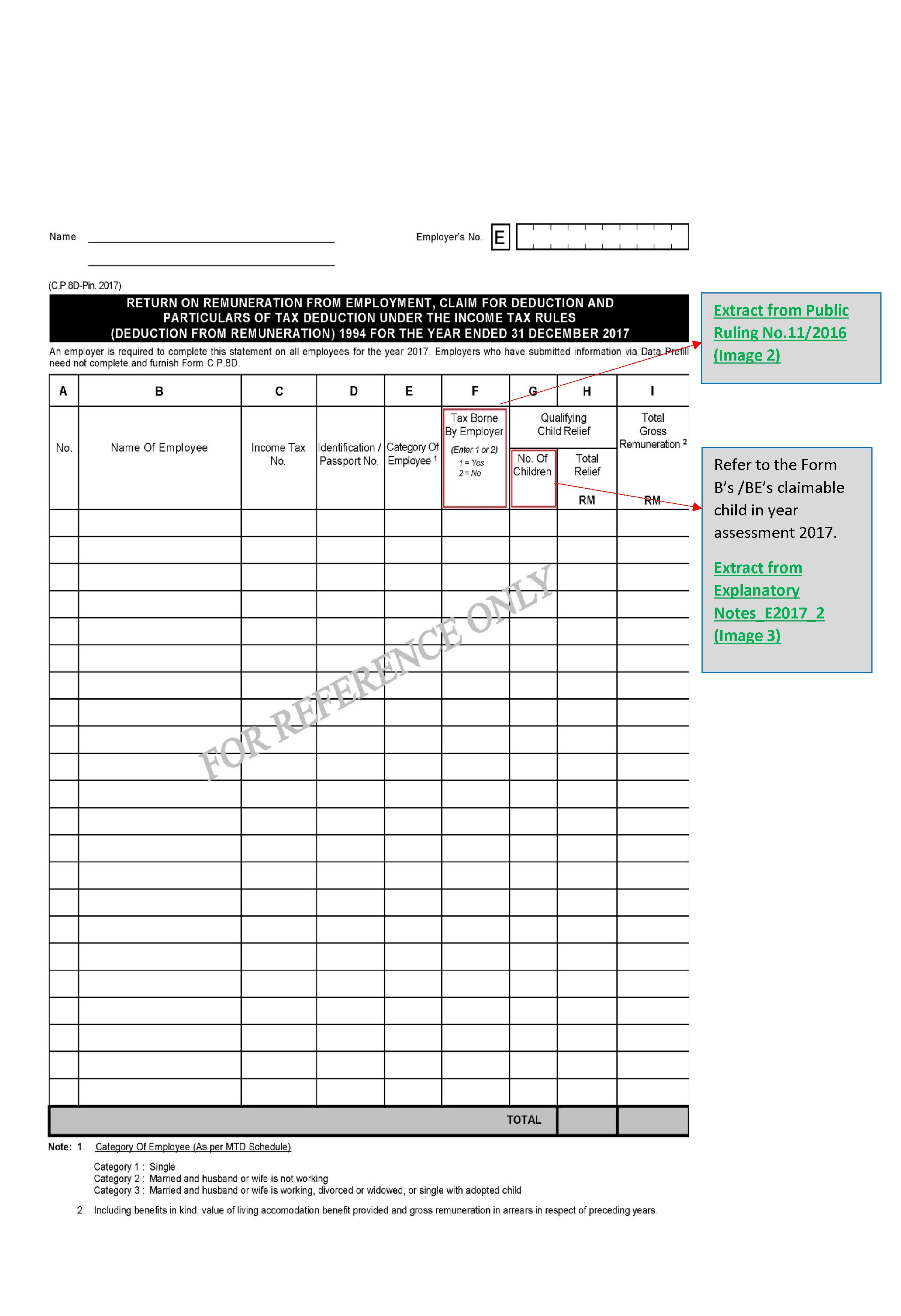

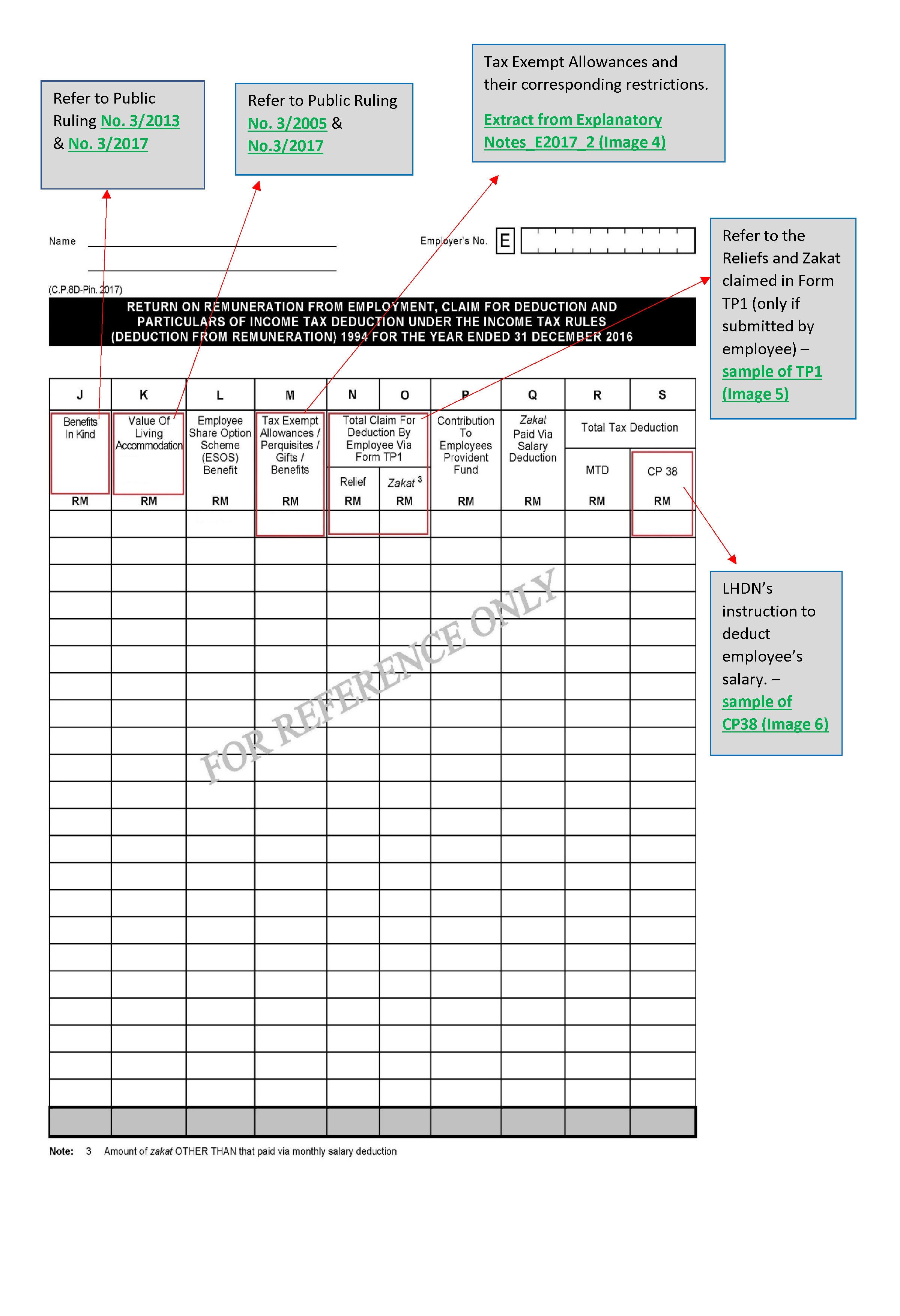

How to submit form e. If you are required to file iras will send your form b from feb to mar. Therefore the information of employee s income on a form e must be consistent with the information stated on an employee s ea form. E file via mytax portal recommended you can e file via mytax portal with your singpass iras unique account.

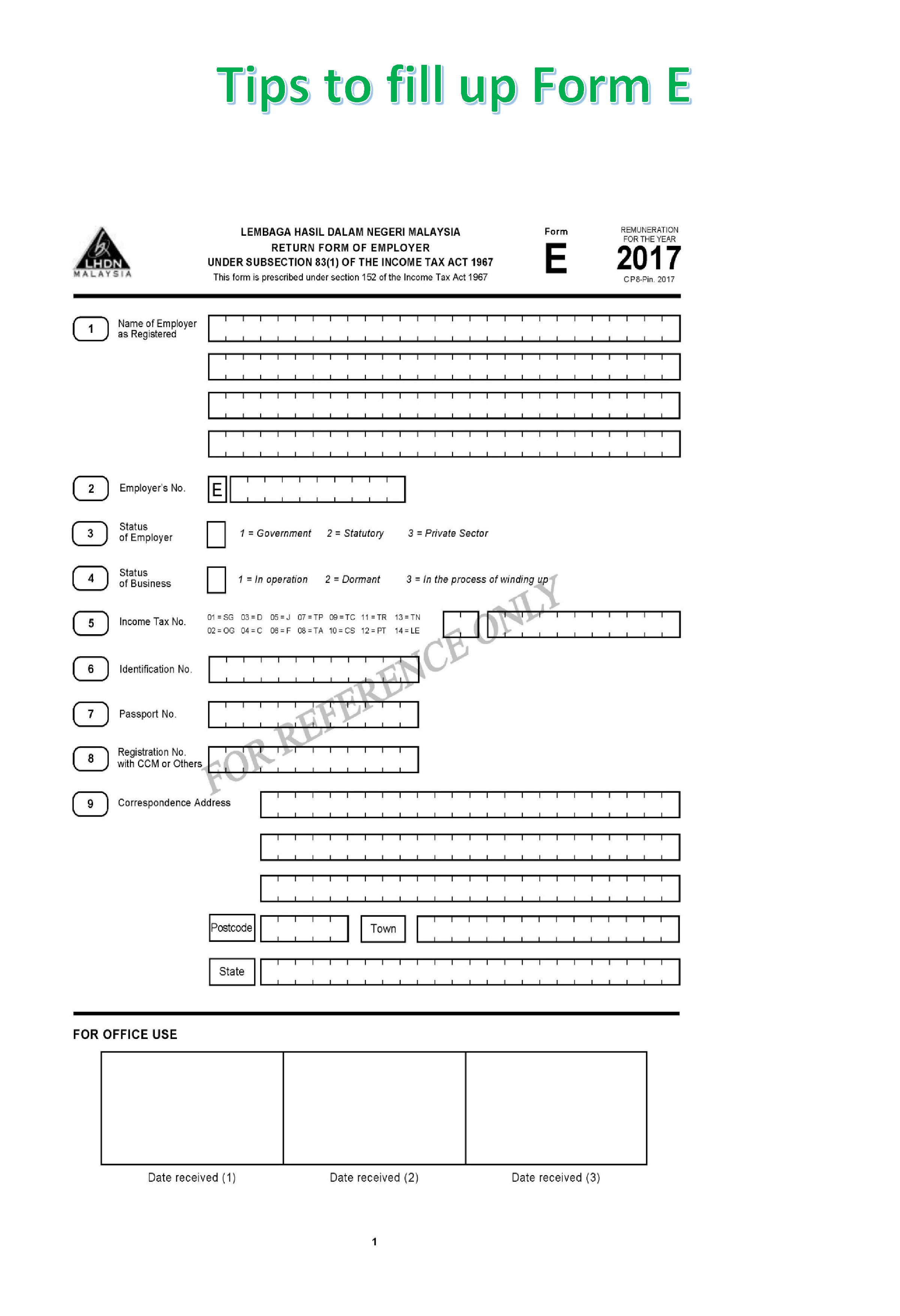

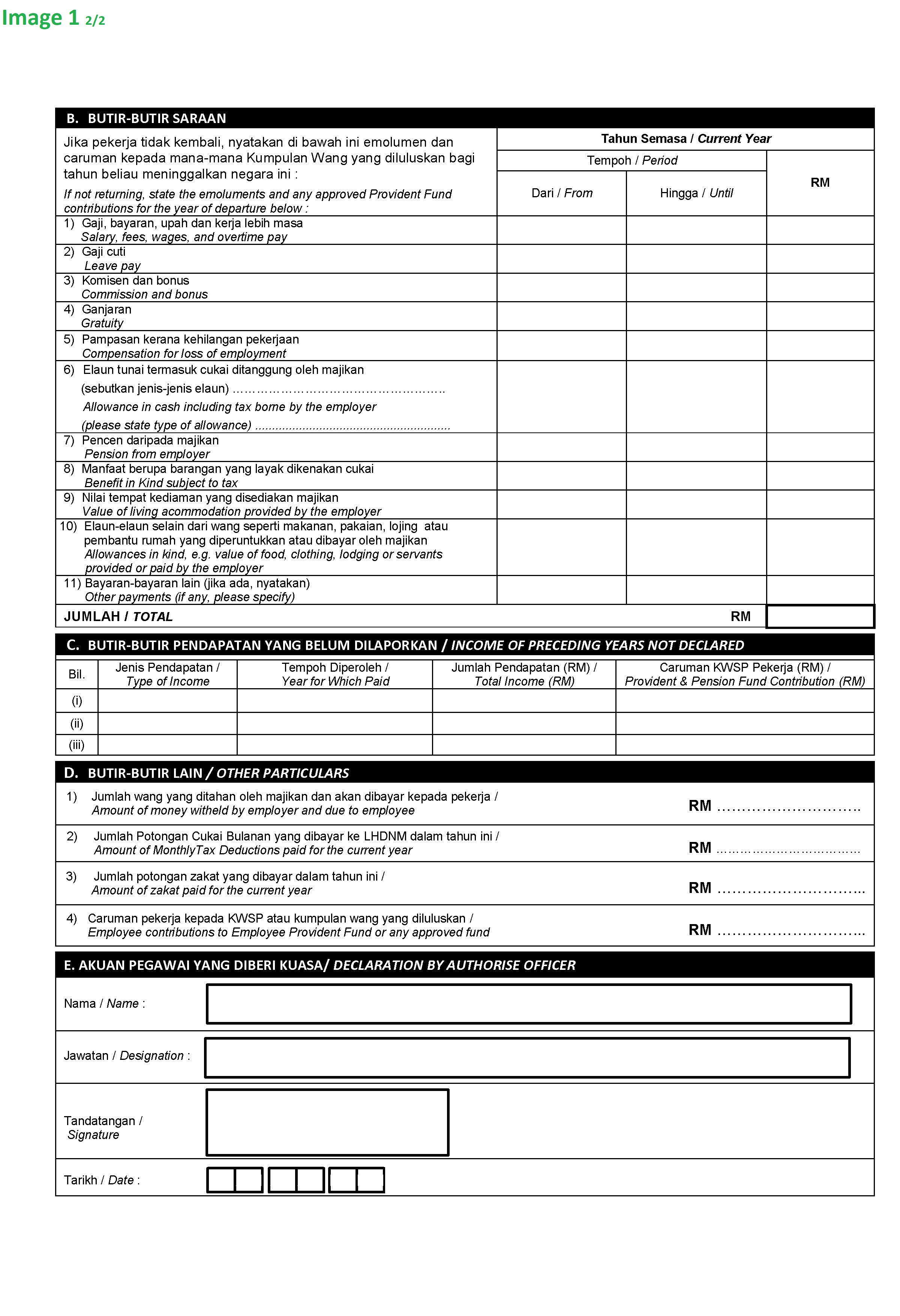

Once you have logged in under the e filing section click on e borang and that will take you to your tax e filing form. Notice for carrying out sewer connection work. Select form type e e and input your income tax no.

Fill in your company details and select muat naik c p 8d in the dropdown. We would advise reading through the document first before attempting to answer any of the questions. The input type submit defines a button for submitting the form data to a form handler.

Failure to do so will result in the irb taking legal action against the company s director. The form handler is typically a file on the server with a script for processing input data. Submit the completed form c s online.

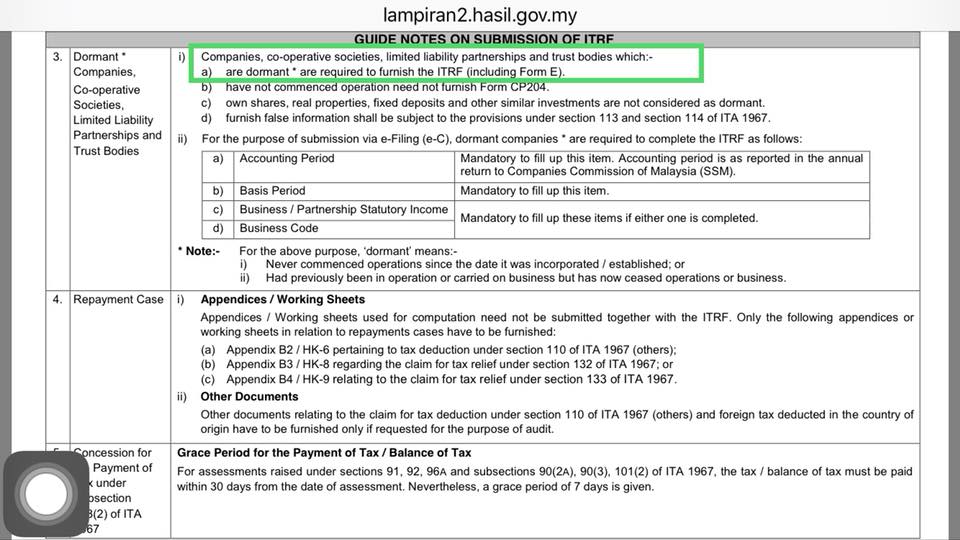

Form e is a large document with multiple questions which can seem rather daunting at first. Click on corporate tax and select file form c s c at the main menu of mytax iras gov sg. Form to be submitted through e form.

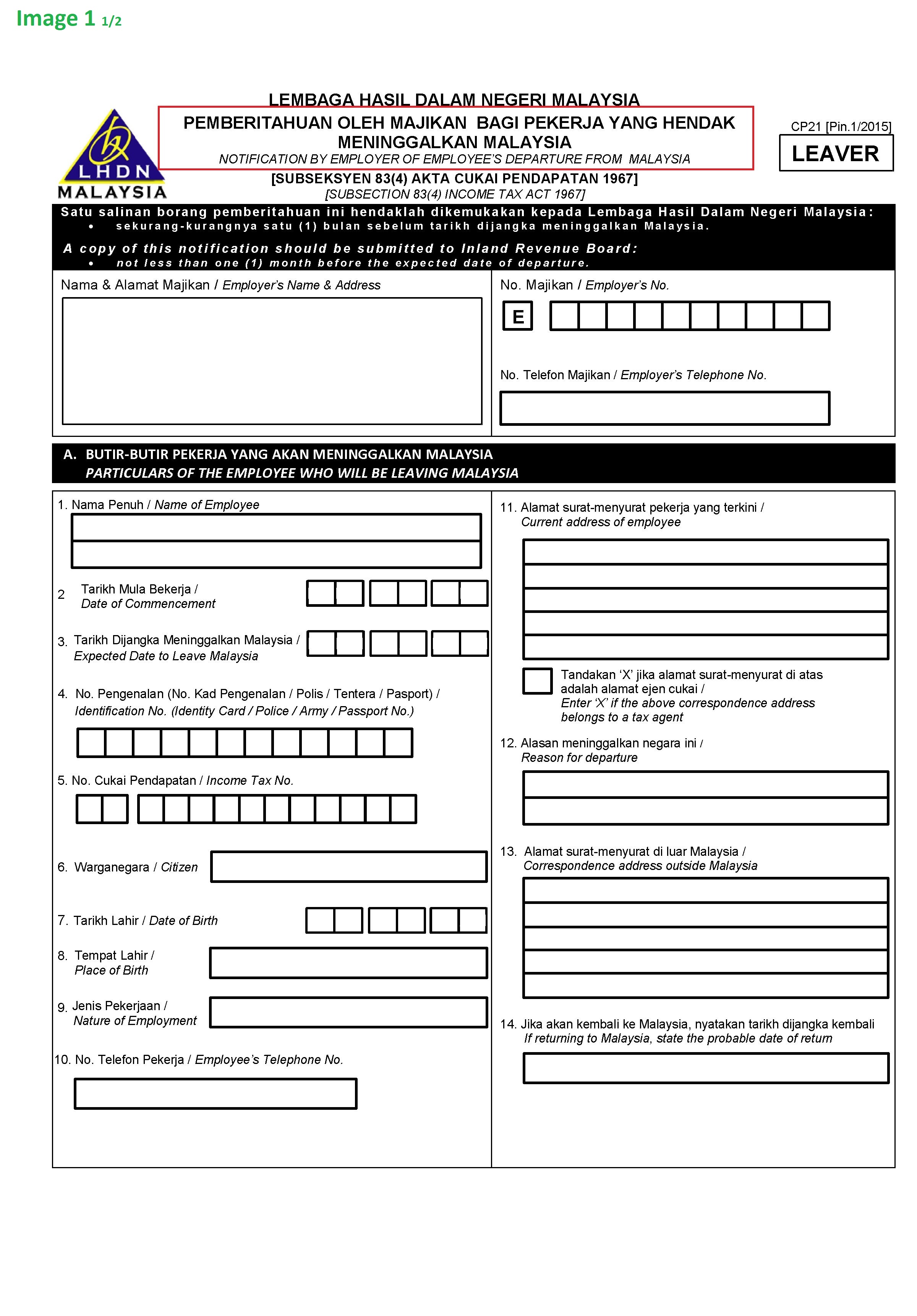

Unlike form e employers do not need to submit ea form to irb. Application to work in public sewerage system for non developmental works submit through e form form b. Form b1 submission procedure.

User manual e form ezhasil version 3 3 user manual e form ezhasil version 3 3 11 7. If you required assistance to e file visit need help to e file paper file. E filing of form c s can only be done via the online form c s.

Choose your corresponding income tax form e be and choose the assessment year tahun taksiran 2015. Users are able to verify entered information such as total income. At summary screen e form will display your tax summary whether it is tax paid in excess or tax payable.

Click on continue button to submit your e form. Form e field by the employer is in fact where the irb can do a cross check on whether an employee is reporting his income correctly. There are two ways to file form b.

Please note that there is no form c s upload service. What if you fail to submit borang e and cp8d. Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees.