Importance Of Retirement Planning In Malaysia

With all the talk revolving around the epf withdrawal age lately the topic of the best retirement plan in malaysia seems to be on the tip of everybody s tongue.

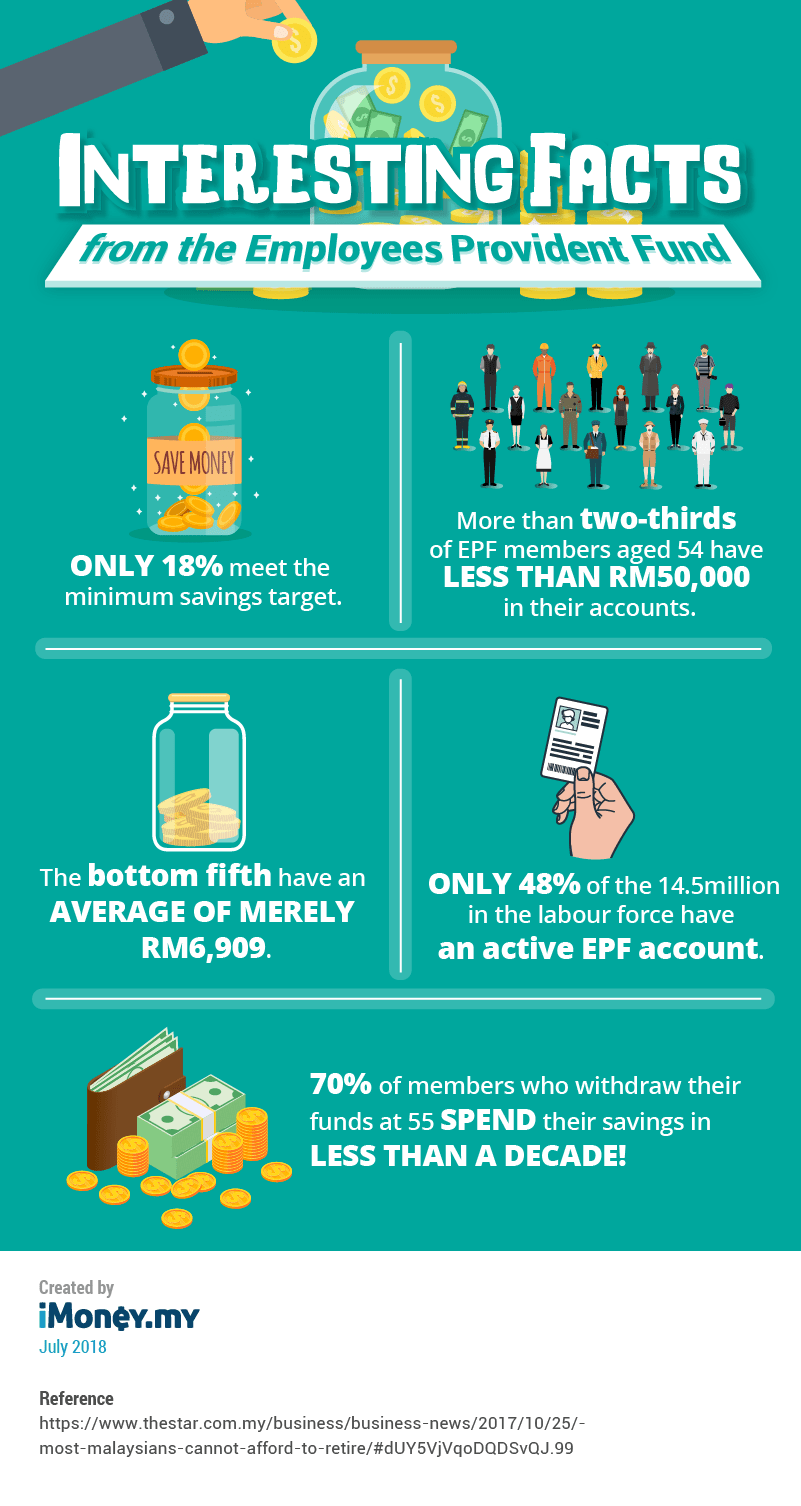

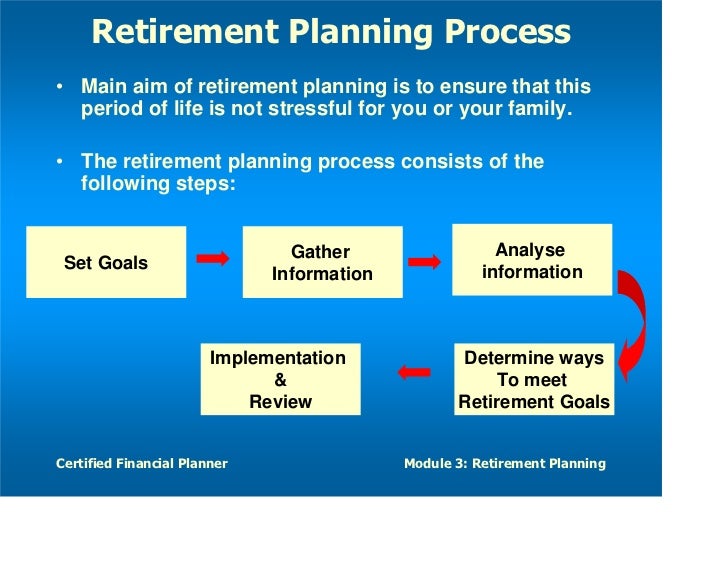

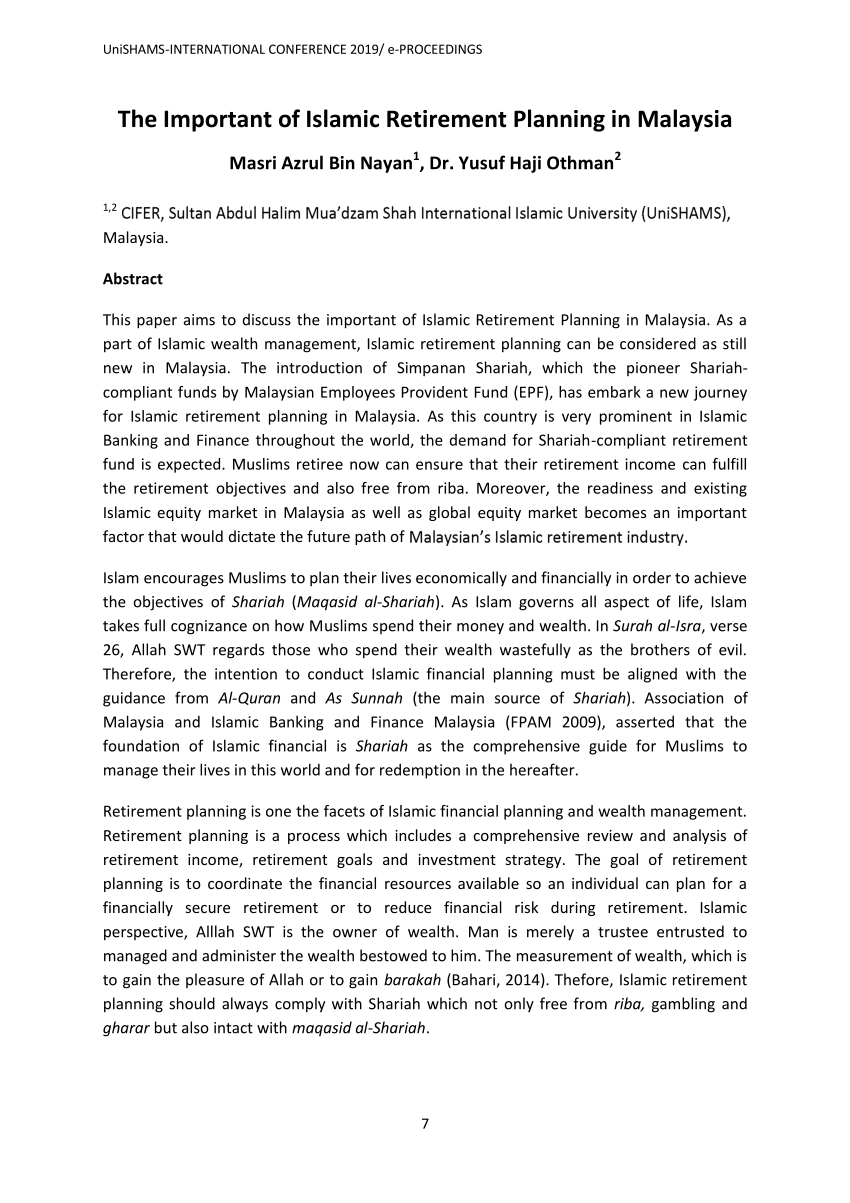

Importance of retirement planning in malaysia. Now you ll need to ascertain the number of years you have before you hit retirement age. Currently the retirement plans available in malaysia such as employee provident fund epf. The rosy picture of a comfortable retirement is becoming a distant dream for many malaysians due to factors such as longevity risk and a growing ageing population.

Still many do not realise the importance of planning for the various phases of their golden years and their long term care needs as well as how to effectively protect their estate when doing so. This means a monthly retirement income of the only rm950 per month assuming a life expectancy of 75 years old. The importance of retirement planning is a call in malaysia due to fast ageing population in the country.

Assuming that you plan to retire at 55 simply subtract your current age by 55 and you ll get this number. Best retirement plan malaysia. Miscalculations in terms of your retirement fund can be caused by common misconceptions such as these.

Last year the employees provident fund epf raised the minimum savings target to rm228 000 by the age of 55. Chart your retirement landscape using retirement scenario modelling and debunk the myth of the 4 withdrawal rule. Every middle class earner destined for decent retirement featured in starbiz the star on 30th may 2015.