Inheritance Tax In Malaysia

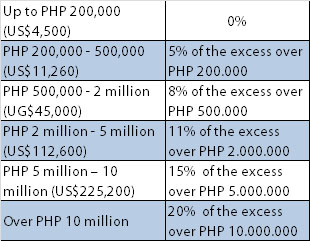

Until then net worth exceeding myr2 million us 543 000 was taxed at five per cent and a rate of 10 percent was imposed on net worth exceeding myr 4 million.

Inheritance tax in malaysia. Talk of a new tax called the inheritance tax being introduced in budget 2018 surfaced a week or two ago. When you inherit a property there are many things to consider. Graph of house price trends in malaysia.

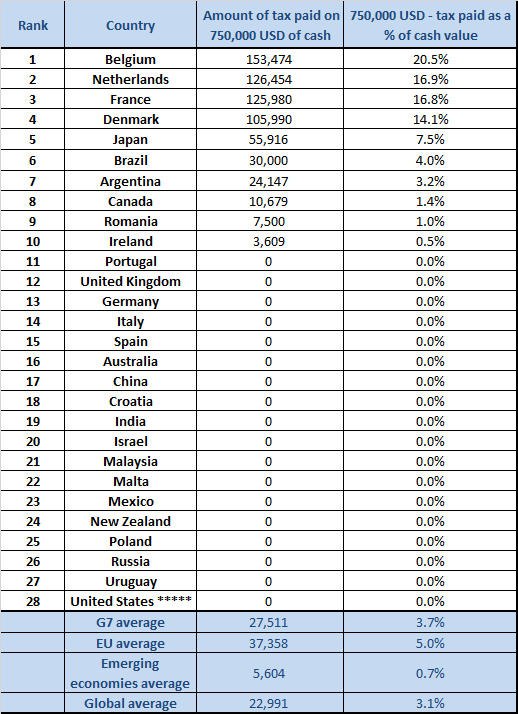

Sources said both capital gains tax cgt and inheritance tax may only be. 1 do i have to pay tax for inheriting property. There are no inheritance estate or gift taxes in malaysia.

Malaysia more data and information. Property tax is levied on the gross annual value of property as determined by the local state authorities. Property prices in malaysia.

Inheritance estate and gift taxes. Inheritance tax and inheritance law in malaysia. How high is income tax on residents in malaysia.

Rumours that the government would introduce such a tax first emerged last. The much speculated taxes on capital gains and inheritance will not be introduced in budget 2019. This was quickly put to bed by second finance minister datuk seri johari abdul ghani who said it was unfounded rumours.

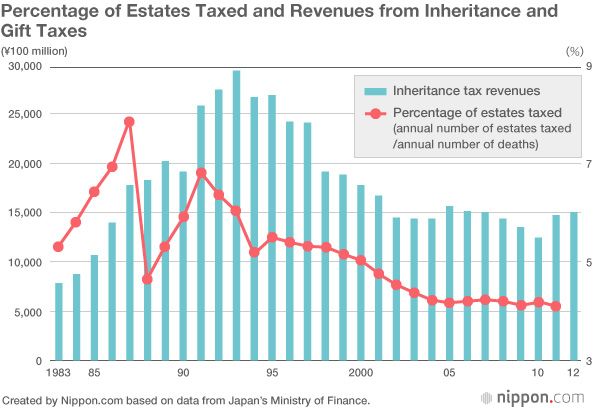

Luxury and excise duties. There s currently no tax for estate inheritance in malaysia. Inheritance tax in malaysia was abolished in 1991.

The launch of the shared prosperity vision 2030 signalled a new era of development in malaysia. July 07 2010 inheritance no inheritance or gift taxes are levied in malaysia. If a person dies intestate without having written a valid will then the provisions.

Information pertaining to writing a will in malaysia and the laws relating to inheritance and distribution in malaysia the purpose of writing a will is for a person to leave behind a legacy for loved ones and to ensure that they are well provided for in the unfortunate event of the testator s passing. Excise duties are imposed on a selected range of goods manufactured and imported into malaysia. Prior to the abolition of this tax in 1991 estate duty was applicable only if the net worth of the estate exceeded rm2 million.

For context malaysia used to have inheritance tax estate duty.