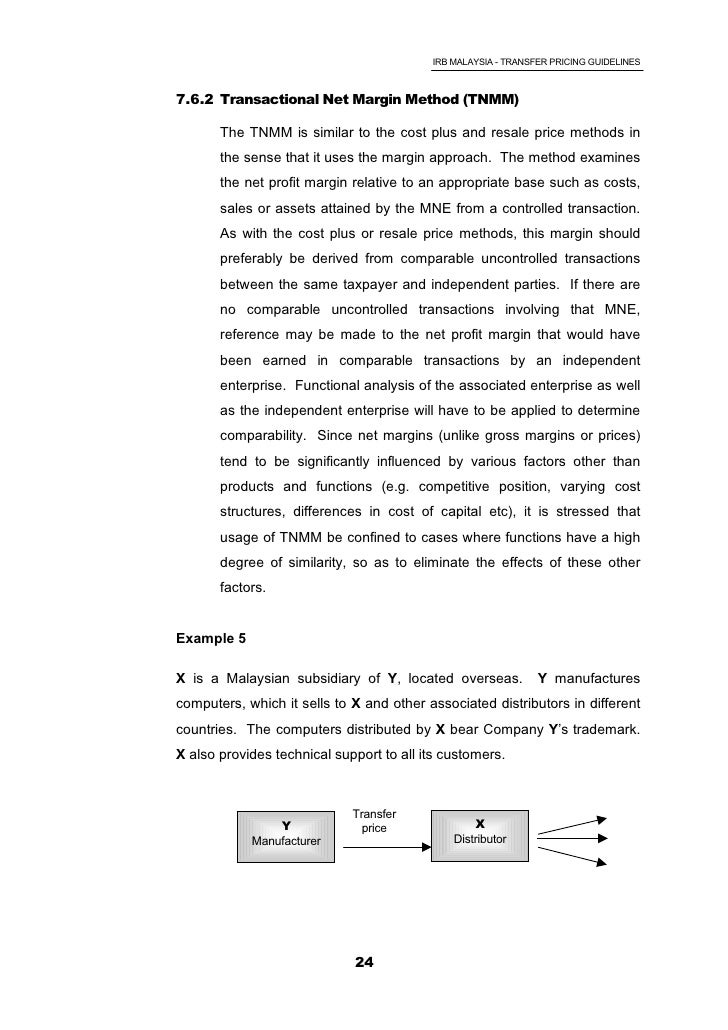

Inland Revenue Board Malaysia Transfer Pricing Guidelines

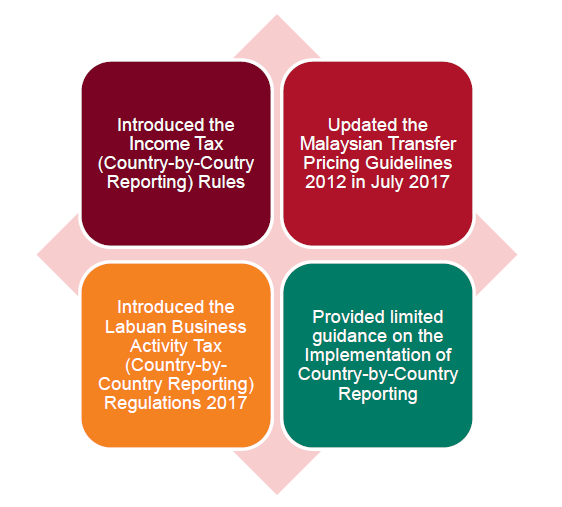

The inland revenue board of malaysia irbm had recently announced new updates and changes to the transfer pricing guidelines 2012 tpg 2012.

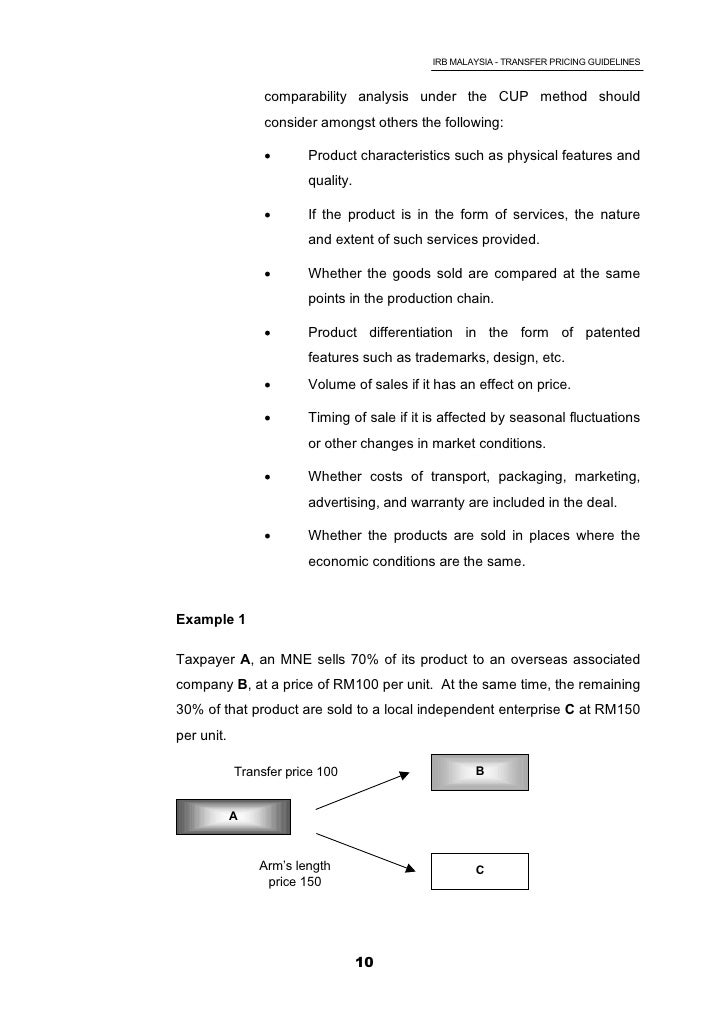

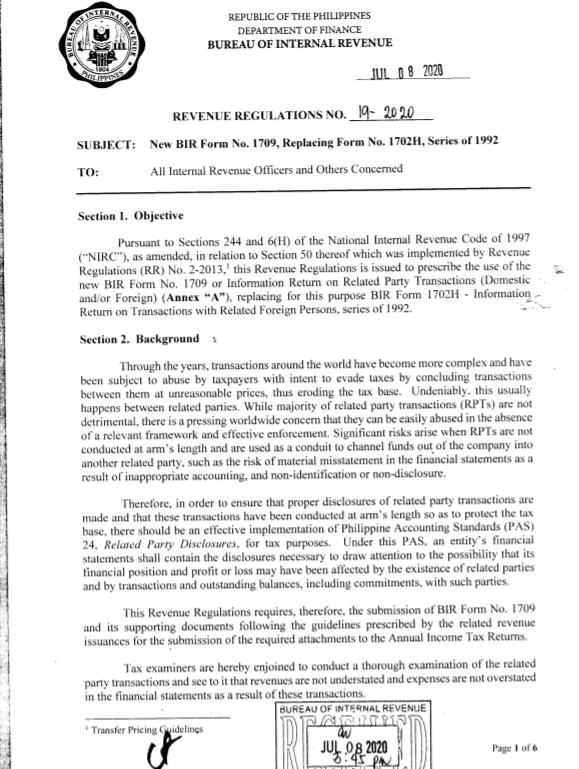

Inland revenue board malaysia transfer pricing guidelines. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Transfer pricing is a key area of focus for the malaysian inland revenue board mirb. The malaysian transfer pricing guidelines explain the provision of section 140a in the income tax act 1967 and the transfer pricing rules 2012.

A transfer pricing guidelines published on 23 february 2006 b transfer pricing consultation published on 30 july 2008 c supplementary administrative guidance on advance pricing arrangements published on 20 october 2008 and d transfer pricing guidelines for related party loans and related party services published on 23 february 2009. 61 3 5911 7001. Inland revenue board of malaysia transfer pricing guidelines 2012.

Recent developments include the introduction of the income tax transfer pricing. The transfer pricing audit framework 2019 is effective from 15 december 2019 and replaces the transfer pricing audit framework 2013 which was issued on 1 april 2013. The malaysian inland revenue board s irb transfer pricing guidelines 2012 were introduced in july 2012 replacing its 2003 guidelines the guidelines explain the administrative requirements of the application of section 140a of the income tax act 1967 and the income tax transfer pricing rules 2012.

Want to make a change. New transfer pricing audit framework 2019 kpmg united states. The malaysian transfer pricing guidelines explain the provision of section 140a in the income tax act 1967 and the transfer pricing rules 2012.

Inland revenue board of malaysia transfer pricing guidelines. Inland revenue board of malaysia transfer pricing guidelines. It governs the standard.

In this regard the guidelines may be reviewed from time to time. The malaysian inland revenue board issued a transfer pricing audit framework 2019 that replaces the transfer pricing audit framework from april 2013 malaysia. Malaysian transfer pricing legislation and regulations are based on the arm s length principle in the organisation for economic co operation and development oecd guidelines.