Is Stock Trading Taxable In Malaysia

I was proven wrong that investing takes hard work unless i want to be a passive investor that will be a different story.

Is stock trading taxable in malaysia. Inland revenue board of malaysia tax treatment of stock in trade part ii withdrawal of stock public ruling no. As a young investor i was eager to learn how to do investment and earn money without hard work. I started trading at klse kuala lumpur stock exchange back in my university years.

Stock pick year 2020 30 sep result stock pick contest year 2020. Capital gain from stocks investment is not taxable in malaysia but here s what you do which can cause it to be taxable. That means rm180 per share or 24 1 yield equals to 13 months int rate of 1 75 in malaysia the investment approach of calvin tan.

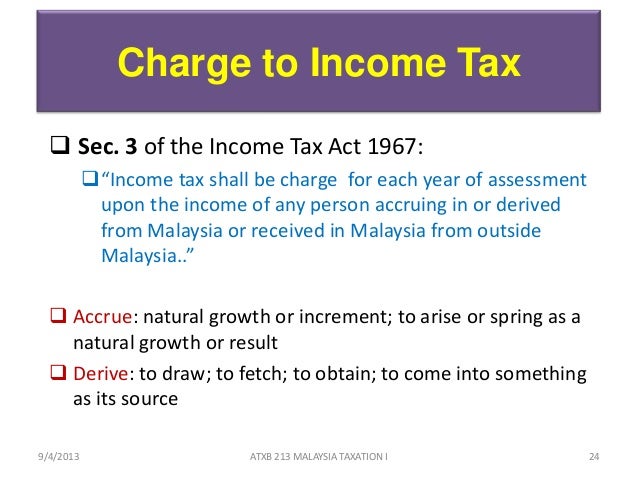

Yes it s true one prominent stocks investor in malaysia starts to kena. Capital the trading stock is valued at the market value. But the profit capital gain is not taxable literally shares that issued by company in malaysia and you buy it is taxable but shares you bought from oversea exhange is not taxable.

It say trading share in malaysia which mean shares you bought from within malaysia exhange like bursa saham is taxable under business income. Naim 5073 at 74 5 sen is giving a 18 sen dividend soon. 3 june 2020.