Islamic Capital Market In Malaysia

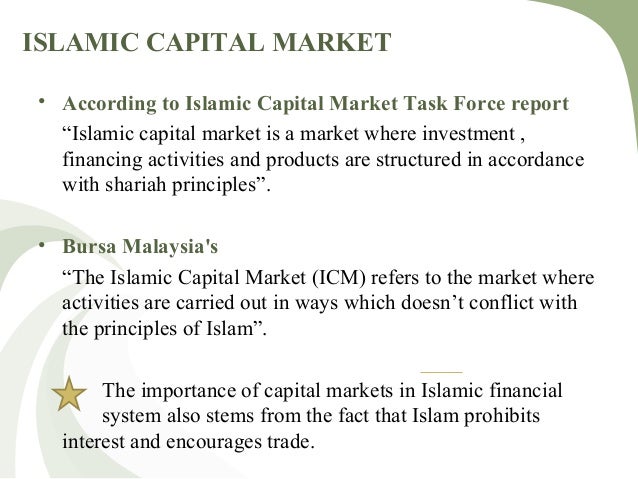

In the icm market transactions are carried out in ways that do not conflict with the conscience of muslims and the religion of islam.

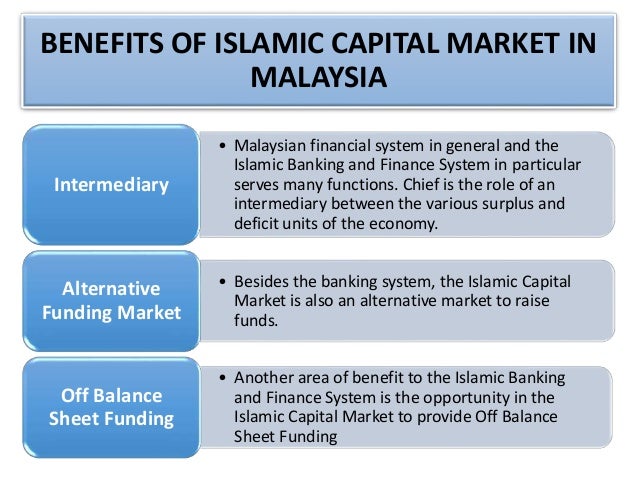

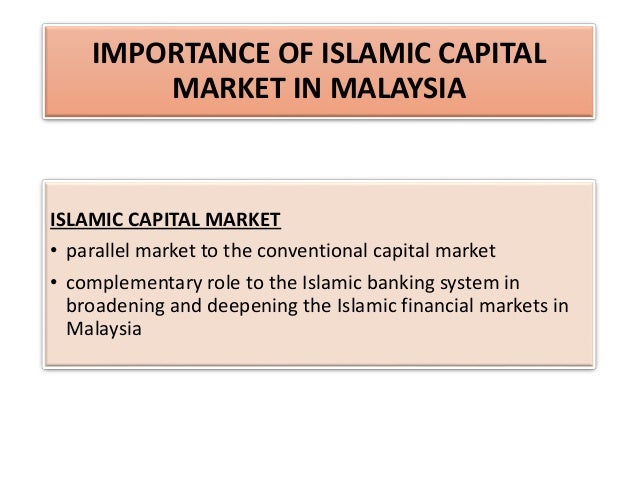

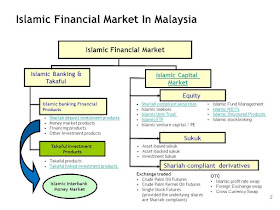

Islamic capital market in malaysia. The islamic capital market icm functions as a parallel market to the conventional capital market in malaysia. The islamic finance industry in malaysia is characterised by having comprehensive market components ranging from islamic banking takaful islamic money market and islamic capital market. The icm is a component of the overall capital market in malaysia.

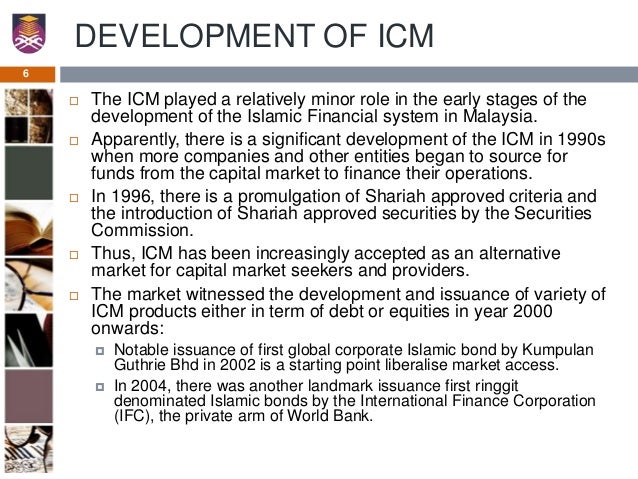

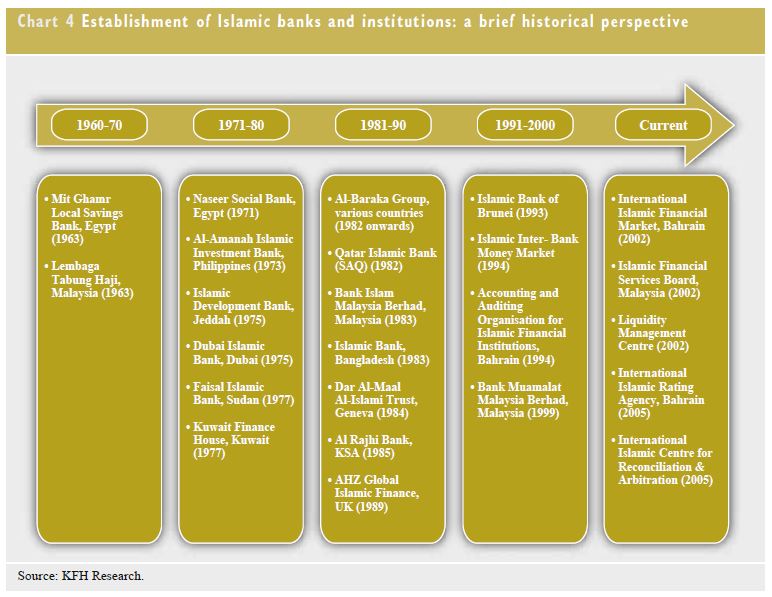

A leader in the islamic capital market malaysia has been able to diversify its market based funding avenues by developing its islamic capital market icm particularly the sukuk segment. The icm functions as a parallel market to the conventional capital market and plays a complementary role to the islamic banking system in broadening and deepening the islamic financial markets in malaysia. In 1990s 6 1990 1993 1994 1995 1996.

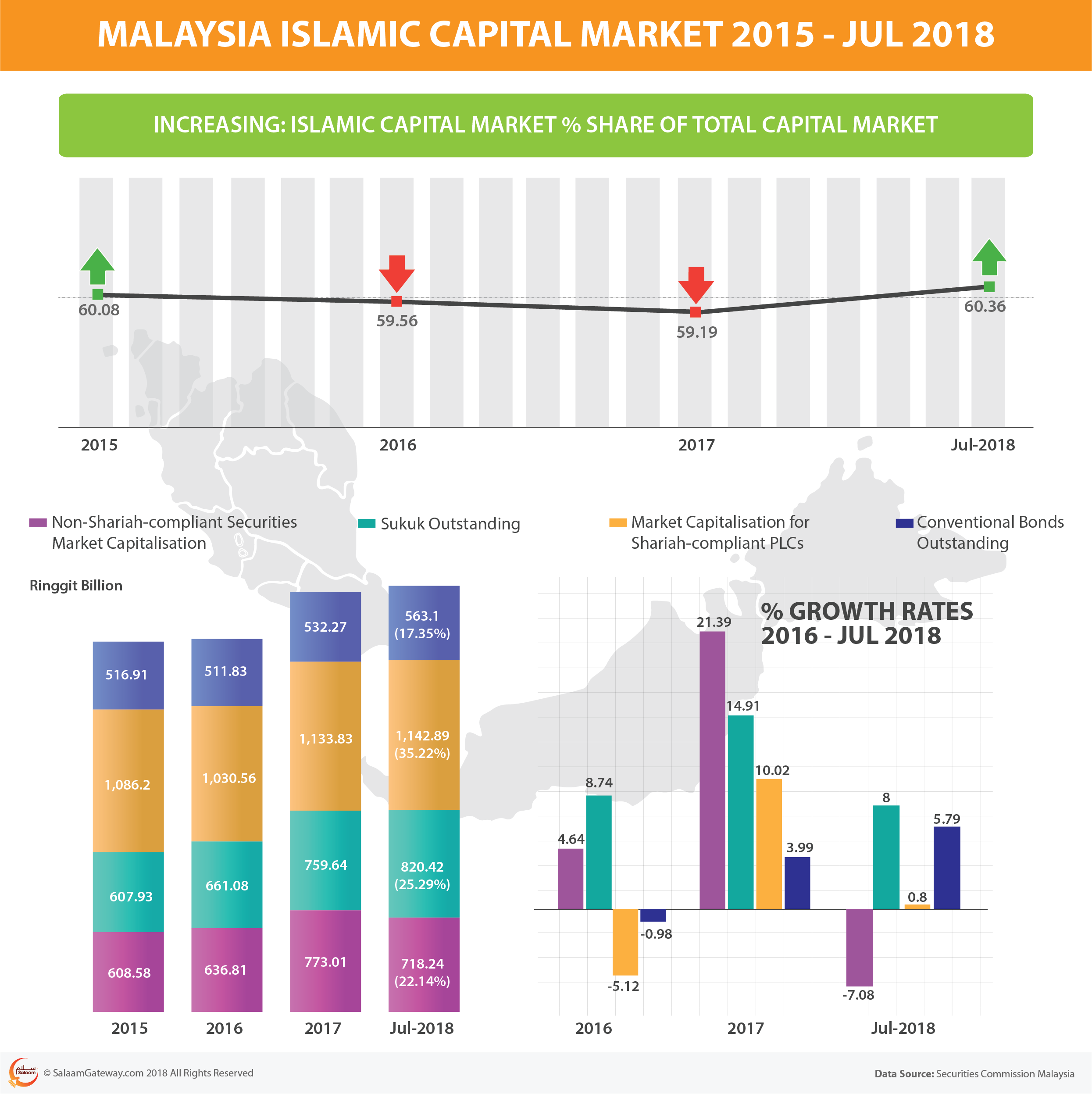

Statistics gathered from bursa malaysia on the islamic capital market. Malaysia s islamic capital market is rm1 67 trillion as at june 2016 as at june 2016 as at june 2016 as at june 2016 as at dec 2016 as at dec 2016 sukuk market 55 rm637 3 bil bond market 42 rm496 0 bil how bursa malaysia plays its role in the islamic capital market. Statistics gathered from bursa malaysia on the islamic capital market.

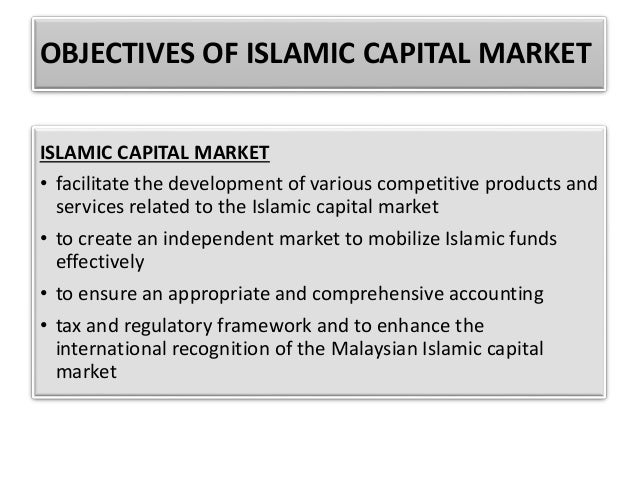

Capital markets and services act 2007. Islamic market to promote malaysia as the international hub of islamic finance bursa malaysia has established an islamic markets team dedicated to the development of shariah compliant capital markets products and trading platform. Malaysian islamic capital market.

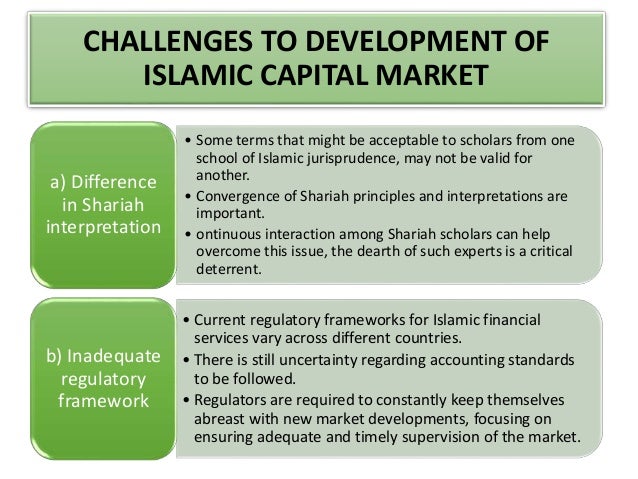

According to ram ratings malaysia was the top sukuk issuer with us 13 9 bil ringgit equivalent or 35 1 of the us 39 5 bil ringgit equivalent sukuk issued in the first quarter ended march 31 2019. The country s icm expanded from rm294 billion in 2000 to rm2 035 trillion as at december 2019. In malaysia where the islamic capital market first got its legs the securities commission of malaysia has a sharia council that is specifically responsible for sharia related matters of islamic capital market activities sharia councils are religious boards steeped in the knowledge of islam and responsible for determining whether an institution s practices and products comply with islamic.

Islamic as result of the commitment and close collaboration between regulators and the islamic finance community the islamic capital market icm is a significant pillar of malaysia s well developed islamic finance industry and is widely recognised as the leading centre for innovation in shariah compliant products and services.